What to know

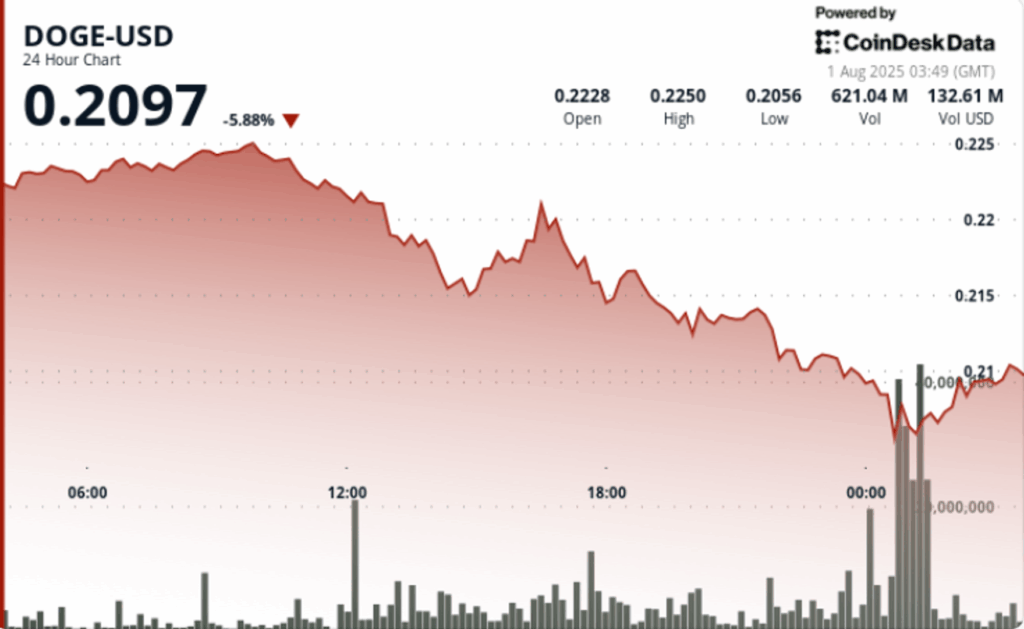

Doge fell 8% of $ 0.22 to $ 0.21 between 03:00 on July 31 and 02:00 on August 1, marking one of the most pronounced daily decreases this month. The price action was developed within a wide range of $ 0.03, between a $ 0.23 peak and a minimum of $ 0.20, a strong resistance to love at the upper limit and capitulation near the session.

The volumes shot sharply during the last hours of the session, particularly at midnight, where trade increased to 1.25 billion Dux, well above the average of 24 hours of 365 million. The movement suggests a greater liquidation activity, probably triggering waterfall sale orders through leverage positions.

News history

• Doge fell 8% for 24 hours as the volume increased to 1.25 billion during trade during the night.

• The resistance to $ 0.23 remained firm despite the first rise attempts, while $ 0.21 emerged as a short -term support.

• Institutional wallets acquired 310 million Dux during correction, pointing out the accumulation during weakness.

• Bit Origin added 40 million dux to his treasure as part of a corporate diversification program of $ 500 million.

• The broader cryptographic markets remain pressed by macroeconomic uncertainty, with the ambiguity of the inflation route and the rate that clouds the feeling in the short term.

Summary of the price action

Doge tried $ 0.23 around 09: 00–10: 00 on July 31, but could not keep the impulse. The accelerated sale during the afternoon and until the night, with the largest fall of a single hour occurring just after midnight. The price reached a minimum of $ 0.20 before stabilizing about $ 0.21, where it found a repeated short -term support.

In the final session of 60 minutes (01: 08–02: 07 on August 1), Dege recovered slightly from $ 0.21 to $ 0.21, registering a modest gain of 1%. The movement, although limited, occurred in a relatively balanced volume and suggests a short -term stabilization. The rejection about $ 0.21 of resistance and narrowing prices band indicates the potential exhaustion of the sale pressure in the immediate term.

Technical analysis

• 8% decrease from $ 0.22 to $ 0.21 with a width $ 0.03 range Between high and bass.

• $ 0.23 resistance Confirmed after the failed rupture attempts.

• Support about $ 0.21 It remains several times during the final time, showing signs of accumulation.

• Volume peak at 1.25 billion Around midnight, an increase of about 3 times over the daily average.

• The price action was reduced in a tight $ 0.21– $ 0.21 band After recovery, signaling of potential base formation.

What merchants are seeing

• If Doge can keep your base above the support range of $ 0.21– $ 0.20 in the next sessions.

• Signs of accumulation of the wallets they acquired during the sale of the sale.

• Macroeconomic signals, including inflation comments from the United States and the feeling of risk of Asian equity, that could influence the broader cryptographic appetite.

• Reaction to the inclusion of DEGE in the strategic assignment of Bit Origin and the possible demands for the demand of future treasury.