Shiba Inu (Shib) fell sharply on early Friday when President Donald Trump’s new rates weighed on Bitcoin market leader and strengthened the US dollar. The price table still offers bullish tracks.

Shib crashed 6% in a brutal sale of 24 hours from July 31, from 11:00 a.m. to 1, 12:00, chopped from $ 0.000013 to $ 0.000012. The prices reach its lowest point since July 9, extending the bearish trend from the maximum of July 21 about $ 0.00001600.

The decrease follows an increase in the number of Shib in centralized exchanges. The count increased to 84.9 billion tokens on July 28, indicating a possible distribution of whales despite the accumulation of $ 63.7 million of 4.66 billion Shib, according to the Coindesk Insights Market model. Meanwhile, the burning rate explodes 16,700% since 602 million tokens shib destroyed in coordinated transactions.

Key insights during the last 24 hours

- The rejection of resistance prices of $ 0.000013 triggered a high volume distribution phase.

- The support base solidified at $ 0.000012 with 1.19 billion purchase interest tokens.

- The rupture volume of 90.51 billion catalyzed a movement above the barrier of $ 0.000012.

What follows?

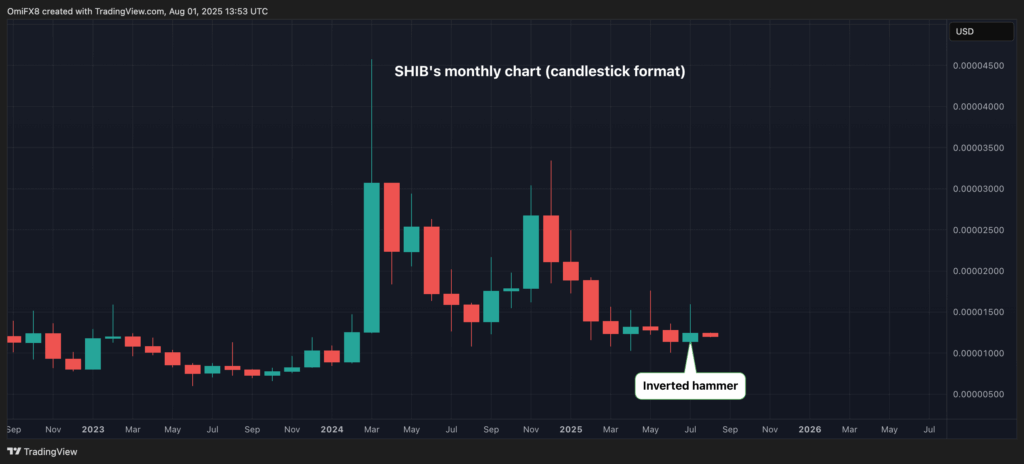

Despite the recent slide, the technical perspective seems constructive, thanks to the candle of “Julio’s bullish hammer”.

The inverted hammer comprises a long wick, a small body and a large wick largely absent. The form indicates that, although the bulls initially took higher prices, the vendors finally dominated and carried the prices almost back to the starting point of the period.

When the pattern appears after a remarkable lower trend, as in the case of Shib, it indicates that the bulls are looking to reaffirm in the market. Therefore, the pattern represents an early sign of an imminent reversal of trends achieved.

Shib merchants, however, must take into account that a fall below the minimum of July of $ 0.00001108 would invalidate the bullish candle pattern.

Discharge of responsibility: parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.