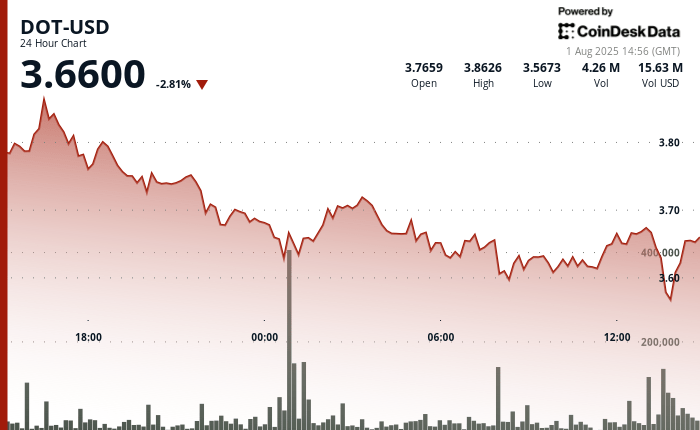

The Polkadot point found a substantial bearish impulse in the last 24 hours, withdrawing from $ 3.76 to $ 3.56, or more than 5%, according to the technical analysis model of Coindesk Research.

The model showed that DOT initially demonstrated resilience, achieving a maximum intradic of $ 3.87 on July 31, but subsequently confronted a relentless sale pressure accompanied by outstanding volume pronounced during the short -decomposition junctures on August 1.

The Token now has support in the range of $ 3.55- $ 3.58, with resistance to the level of $ 3.68, according to the model.

In recent negotiation, the DOT was 5.3% lower in 24 hours, quoting around $ 3.64.

The Polkadot decrease occurred when the broader cryptographic market also fell, with the broader market meter, the Coindesk 20 index, recently dropped 3.7%

Technical analysis:

- The price was removed from $ 3.76 to $ 3.56, which represents a 5% decrease for 24 hours.

- The Intradía peak reached $ 3.87 at 4:00 p.m. UTC on July 31 before selling intensified pressure.

- The volume exceeded the average of 24 hours of 3 million during periods of key decomposition.

- Substantial resistance confirmed at a level of $ 3.68.

- Fresh support established around $ 3.55- $ 3.58 rank.

- The critical support violation occurred at $ 3.60 during the decrease in the final hours.

- The new resistance formed around $ 3.67.

- The volume peaks exceeded 200,000 units for 13: 45-13: 46 UTC and 13:54 UTC periods.

- Insignificant commercial activity recorded in the last three minutes, which suggests market depletion.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.