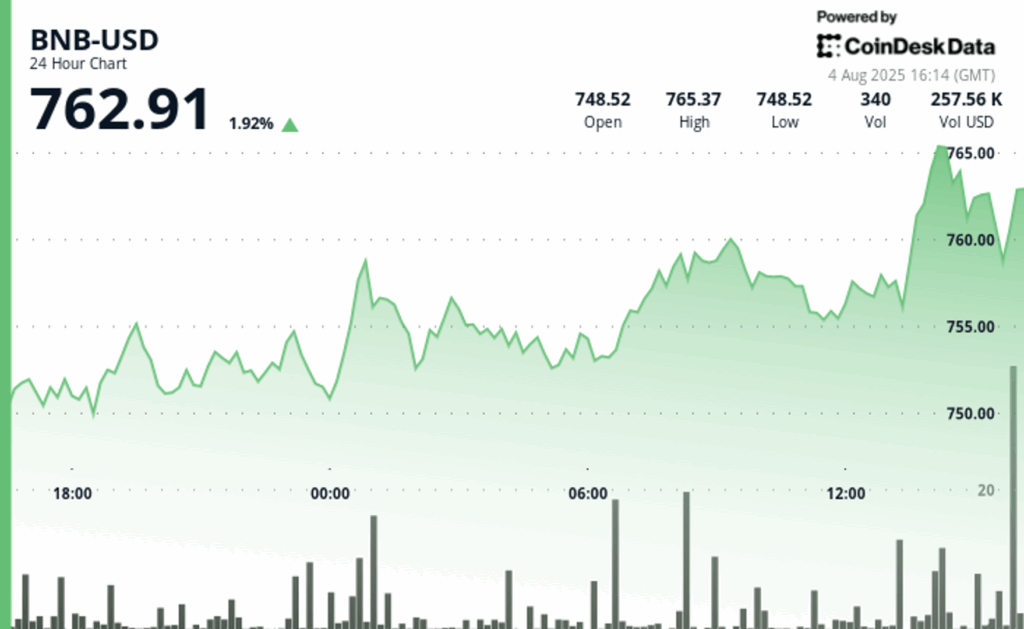

The BNB price rose almost 2% in the last 24 hours to exceed the $ 760 brand, with data that shows an activity explosion behind the price increase.

The volume increased almost 50% above the daily averages, according to the technical analysis model of Coindesk Research. The price action followed a two -phase accumulation textbook: early consolidation, then a break driven by the coordinated purchase that promoted technical resistance levels.

This cola wind coincides with recent Binance developments, a key player in the BNB ecosystem. Crypto’s exchange launched a web version of his Binance wallet, allowing users to approve operations up to seven days in advance to reduce friction for active or high frequency merchants.

Binance also opened the bitcoin options written to all users, eliminating VIP restrictions. Merchants still need to approve risk and post collateral controls. They obtain a 20% discounts on the platform rates, even in contracts called BNB.

A wave of corporate adoption is pointing out a growing confidence in BNB, with several companies that are quoted in the United States that announce significant financial commitments with cryptocurrency. CEA Industries (VAPE), which, with the support of the family office of the co -founder of Binance Changpeng Zhao, Yzi Labs, announced an ambitious plan to raise up to $ 1.2 billion.

The Liminatus Pharma clinical stages (Limn) is also launching a dedicated BNB investment arm with a $ 500 million financing objective, while Windtree Therapeutics (Wint) has revealed a strategy to acquire $ 700 million in BNB.

Meanwhile, the Nano Labs technology company has already taken measures, informing the purchase of 128,000 BNB as a cornerstone of its new Treasury Crypto initiative.

General description of the technical analysis

BNB’s price action shows distinctive stamps of a managed demonstration. The volume concentrations far exceeded the norms per hour at the key points of the movement, pointing out the coordinated purchase.

An outbreak through resistance levels at $ 759 and $ 761 arrived with a minimum sliding, often a deeper liquidity indicator and pre -structured entry points typical of corporate treasure bonds.

The asset maintained a company around $ 745.81 during the previous consolidation, establishing a clear support zone. From there, he went up in measured steps, breaking technical ceilings and maintaining profits.

Discharge of responsibility: Parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.