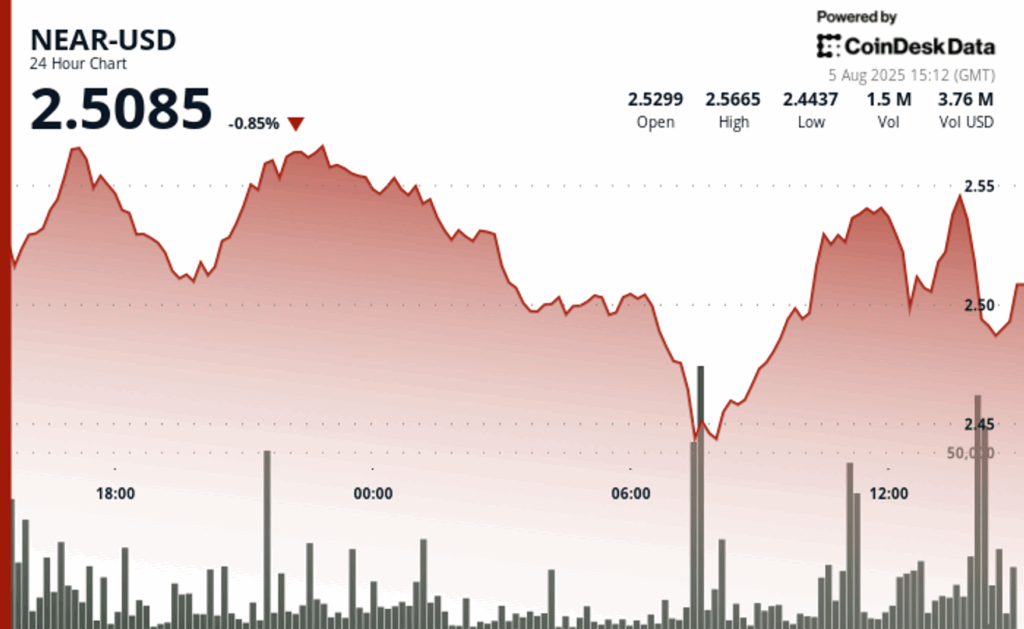

The technical analysis shows a volatile recovery pattern

Near operations in extreme volatility in 24 hours that end August 5, 14:00. The price balance $ 0.13, which marked 5% between $ 2.57 peak and $ 2.44 floor.

The morning sale arrives at 07:00, driving from $ 2.48 to $ 2.44. The volume increases to 3.2 million units, confirming a great institutional discharge.

The support is maintained at $ 2.44 with a mass volume support. Bulls intervene immediately. The recovery of the rally is pressed to $ 2.54 for closing of the session. The technical investment pattern arises as buyers defend the key support zone.

Technical indicators highlight market dynamics

- Near publications of $ 0.13 negotiation range, which represents a 5% volatility between $ 2.57 high and $ 2.44 minimums during the session

- Morning helmet from $ 2.48 to $ 2.44 at 07:00 triggers a mass increase of 3.2 million volume units, confirming institutional sales pressure

- The recovery phase establishes an ascending channel with $ 2.52 support and resistance levels of $ 2.54

- Final time from 13:09 to 14:08 offers a bullish rupture pattern, publishing 1% profits

- The volume concentration reaches more than 100,000 units per minute during window 13: 33-13: 39, institutional accumulation signaling

- The commercial volume falls to zero in the last three minutes, which suggests an institutional position before the possible movement of the rupture

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.