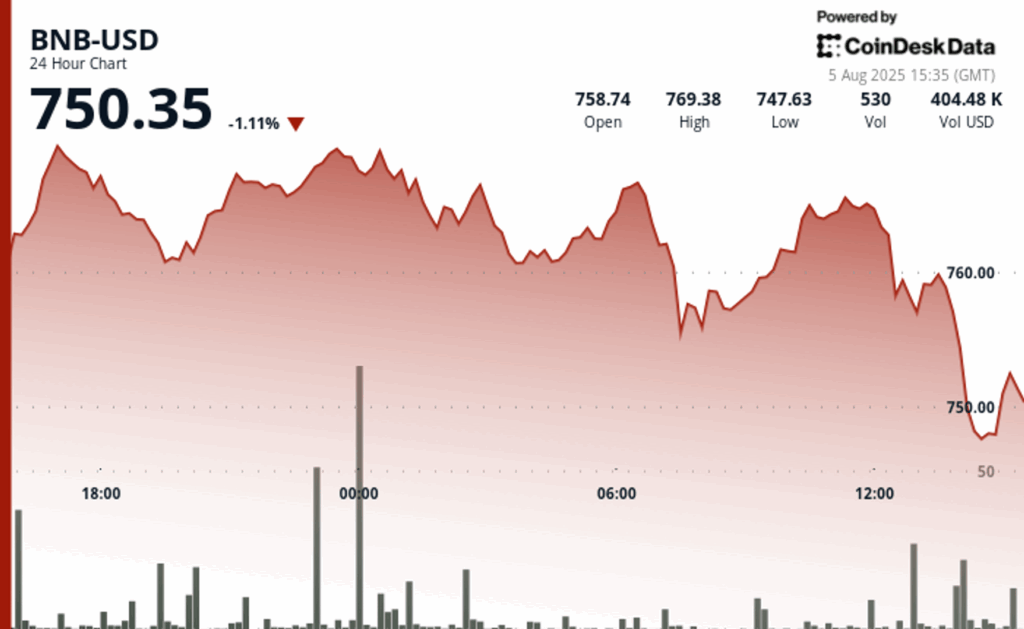

BNB fell more than 1% in the last 24 hours to fall briefly below the support level of $ 750, which is currently enduring. The fall occurred after a brief rally that moved it on the $ 760 line.

The previous cryptocurrency rally was driven by corporate adoption and Binance products launches. The fall occurred as a broader market sale, caused by the decrease in Bitcoin to $ 112,800, caused $ 360 million in liquidations according to Coinglass.

Just a day before, BNB crossed the key resistance levels at $ 759 and $ 761 in a coordinated purchase wave, according to the technical analysis model of Coindesk Research. The volume increased 50% above the daily averages, fed in part by launching a web version of its wallet and opening the bitcoin options that are written to all users.

That optimism came in the midst of corporate accumulation. CEA Industries announced a fund collection plan focused on BNB of $ 1.2 billion, while Liminatus Pharma and Windtree Therapeutics revealed $ 500 million and BNB commitments of $ 700 million, respectively. Nano Labs informed having bought 128,000 BNB for his corporate treasure.

Those profits demonstrated short duration. BNB fell from its maximum local of $ 769.70 in the midst of an increase in the volume of 49,000 tokens that indicated a great sale.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.