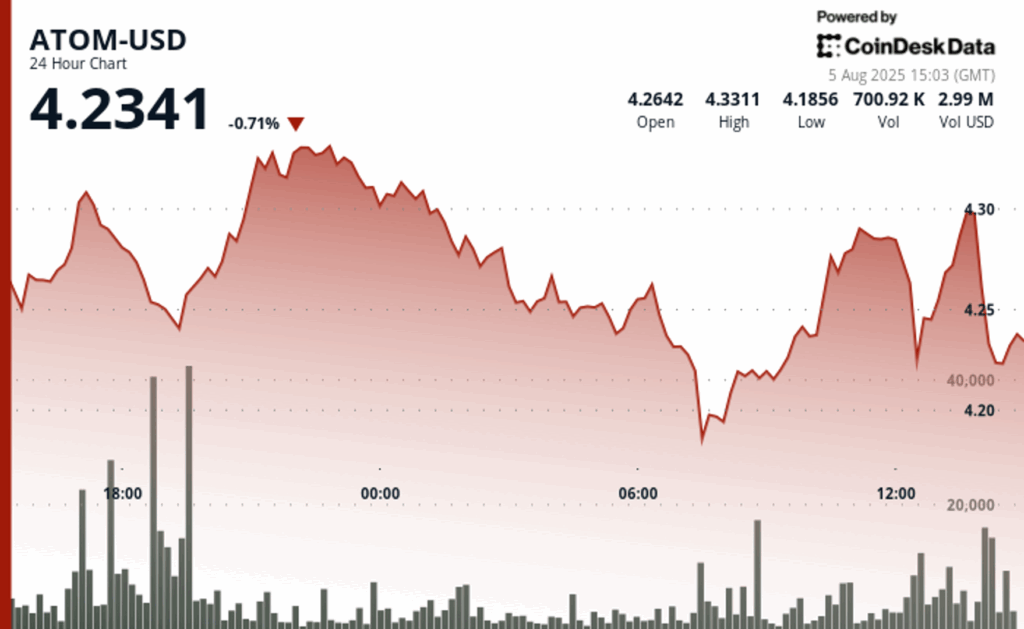

The native token of Cosmos, Atom, exhibited a remarkable resilience during a volatile 24 -hour negotiation period that ends on August 5, abruptly recovering from the minimums intradic as institutional activity was returned. After a dramatic immersion at $ 4.18 during the first hours of negotiation of the USA.

ATOM increased 3% of its support zone of $ 4.18, rising to $ 4.30 in less than seven hours before consolidating over $ 4.27. The rebound was accompanied by a significant volume, particularly between 13:32 and 13:48 UTC, when two successive peaks of 84,604 and 126,803 units indicated the accumulation of sophisticated operators. The price action of one hour from 13:09 to 14:08 UTC highlighted the upward position of the market, with a brief consolidation that replaces the previous volatility, which suggests that merchants are tactically positioning for a break above resistance.

This ascending impulse followed a broader swing of 24 hours from August 4 to 5 that saw atom fluctuate fluctuating between $ 4.18 and $ 4.34, a range of 3.46%, macroeconomic uncertainty Global Water, including divergent monetary policies between central banks and geopolitical instability in progress. With digital assets increasingly seen as coverage tools during stress of the fiduciary market, the ATOM yield reflects broader changes in the institutional investment appetite.

Technical metrics emphasize critical levels

- Negotiation range of $ 0.15 representing a volatility of 3% between $ 4.34 peak and $ 4.18 channels during the 24 -hour period.

- Solid support formation at a level of $ 4.18- $ 4.19 with aggressive buyer intervention during the morning decline.

- Key resistance identified about $ 4.33- $ 4.34 based on session maximums and previous rejection points.

- Peak volume of 1,768,342 units during the recovery phase indicating institutional accumulation patterns.

- High volume consolidation around $ 4.27- $ 4.29 that suggests a new support base formation.

- Zero volume in the last 20 minutes that indicate market positioning before the following directional movement.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.