Companies that buy Ether (ETH) for their treasure strategy are a better purchase for investors than the funds quoted in the ETH Spot Stock Exchange (ETF), said Standard analyst Chartered Geoff Kendrick.

The analyst said that these companies are attracting attention not only for their holdings but also because of their financial structure, which is beginning to be attractive to investors.

“The NAV multiples (market capitalization divided by sustained ETH value) have now also begun to normalize for Treasury ETH companies,” Kendrick said, adding that this dynamic is making the “Treasury companies now very invertible to investors seeking access to the appreciation of ETH prices.”

Buy ETH for the balance, following the Bitcoin (BTC) purchase strategy of Michael Saylor, has recently taken off. Many companies that quote on the stock market have risen on board and have seen that the prices of their shares initially increase, which increases their market capitalization and NAV multiples. Now, their Christmas multiples are getting off their initial peak.

Some of the main companies that enjoy this euphoria of the market include bitmine immersion technologies (BMNR) and Sharplink Gaming (SBET).

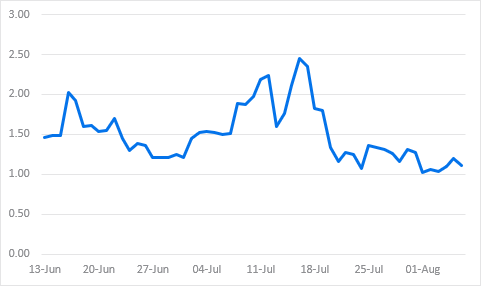

Among these companies, Kendrick highlighted the Sharplink Gaming (SBET) NAV multiple, which was at about 2.50 and is now reduced to a more standardized level of about 1.0. This means that its market limit is only slightly higher than the value of its ETH holdings.

Undoubtedly, the analyst said that he does not see any reason for the ship below 1.0, since these treasure companies provide investors “regulatory arbitration opportunities.”

Kendrick also stressed that these treasure companies have bought as much ETH as funds (ETF) quoted by the exchange of spots in the United States since June.

Both groups now have about 1.6% of the total circulating ETH supply, just under 2,000 ETH, during that period of time, which increases their call that both the treasury and ETF holders now provide an exhibition similar to ETH, everything else is the same.

The combination of these two factors is now added to your thesis that ETH Treasury works are better purchase opportunities than ETFs. “Given Christmas multiples are currently above 1, I see Eth Treasury companies as a better asset to buy than the United States ETF spot Eth,” he said.

Standard Chartered maintains its year -end year price of $ 4,000 for Ether. ETH is currently quoted at $ 3,652, 2% more in the last 24 hours.

Read more: Ether Treasury Companies to finally have 10% of the offer: Standard Chartered