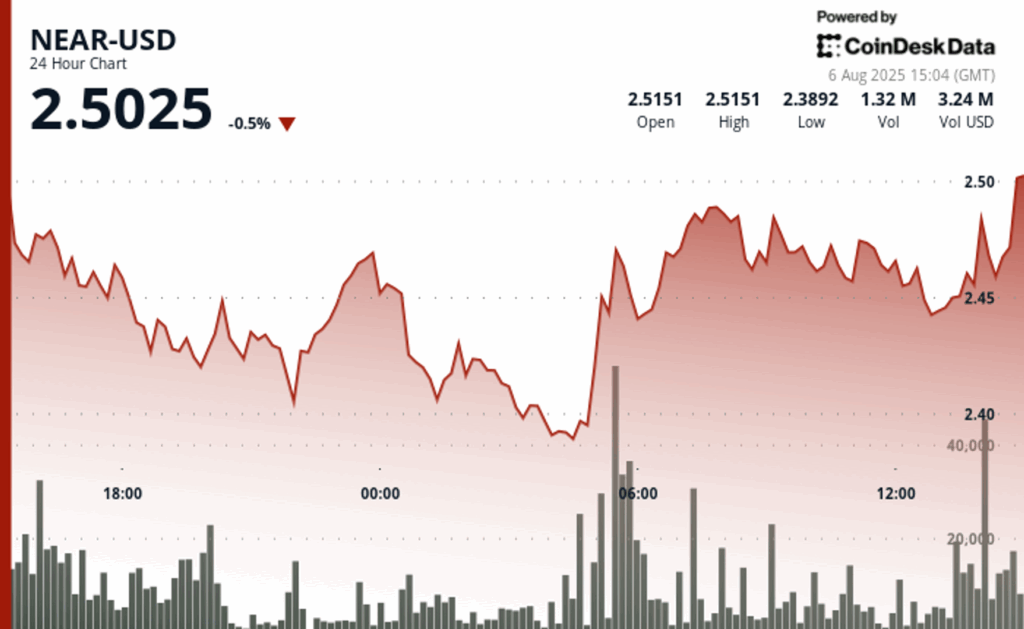

Near Protocol published a remarkable intra -rupture on August 6, rising from $ 2.44 to $ 2.47 within an hour, since it pierced the resistance of the key about $ 2,495. The movement followed the accumulation of around $ 2,448 and was confirmed by a strong volume increase, more than 101,000 units at 13:31 UTC and more than 150,000 in window 13: 36–13: 40: Validation of bullish impulse. The Token closed the session about $ 2,466, establishing a new support zone and reflecting sustained institutional interest.

In a broader 23 -hour window, about $ 2,387 and $ 2,517, recovering from the minimums of the early session with an increase that led the daily volume to 3.44 million, more than double the average. Analysts cite the growing integration of cross -chain developers and initiatives, including pilot work with Cardano, as promoters of long -term advantage. With the price consolidation above $ 2.44, Near remains positioned for higher profits if the support is maintained.

Technical metrics emphasize the bullish impulse

- Negotiation bandwidth from $ 2,387 to $ 2,517 that reflects the total range of 5% during the consolidation period.

- The volume validated support formed around $ 2,390 with 3.44 million negotiated units.

- The resistance zones identified at $ 2,454, $ 2,460 and $ 2,495 penetrated successfully during the progress.

- Price consolidation above $ 2,440 reflects a solid technical basis.

- Volume expansion periods that exceed 150,000 validated units of progress legitimacy.

- Fresh Suport Foundation formed approximately 2% above the opening levels of the session.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.