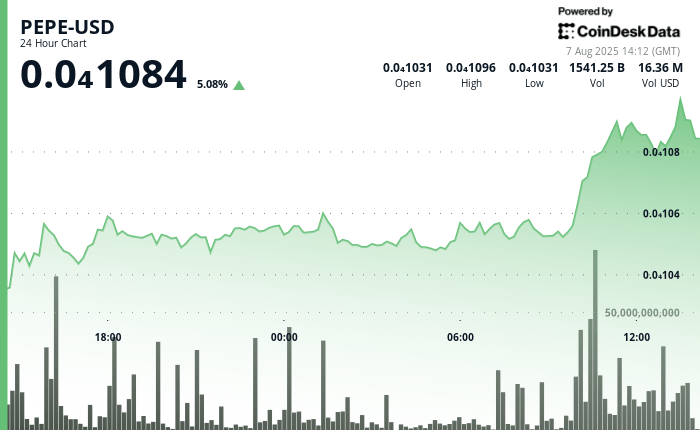

The popular Memecoin Pepe has increased more than 5% in the last 24 hours, driven by a high volume break that helped token prices above a recent level of resistance.

The ascending trend was formed in a series of higher minimums, a sustained purchase interest sign, according to the technical analysis data model of Coindesk Research. The volume peaks accompanied each higher movement, which suggests that larger investors may be accumulating.

While the rally has technical strength, the broader context is more complicated.

The negotiation volume in PEPE derivative contracts has fallen 73% since mid -July according to coinglase data. This drop in activity occurs in the midst of an increase in Pepe tokens holdings of the 100 largest directions in the Ethereum Network. In the last 30 days, these addresses added 2.36% to their holdings, while Exchange reserves fell by 2.4%, by Nansen.

Pepe’s increase is probably linked to a continuous demonstration in risk assets, driven by the growing expectations that the Federal Reserve will reduce interest rates in 25 PB in September. The Fedwatch of the CME tool is currently weighing 93% possibilities that this happens, while Polymarket merchants provide opportunities to 79%.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.