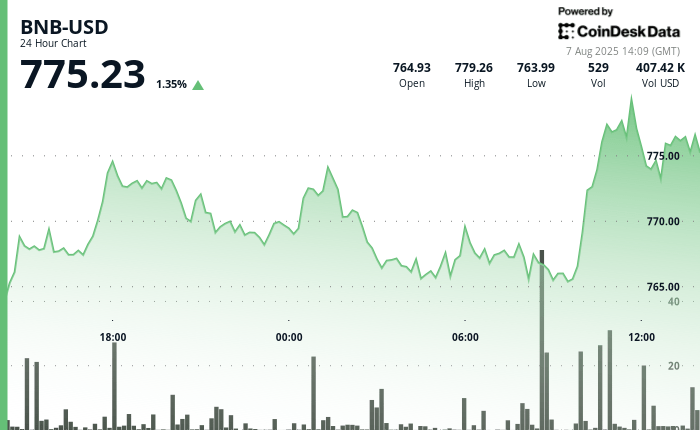

BNB was around $ 780 after an acute rally earlier in the day gave way to the sales pressure.

The cryptocurrency advanced approximately 1.3% in the last 24 -hour period, with a small setback in the last hours. The Token is now around $ 776.

At the beginning of the session, an increase in the negotiation volume led BNB to a local maximum of $ 778, testing resistance levels that have not been violated in recent weeks. The movement was short.

According to the technical analysis model of Coindesk Research, it followed it, which obtained the price and draft earnings during the advance of Coindesk Research.

The measure is produced in the middle of a wave of corporate adoption that recently saw CEA Industries close a private placement of $ 500 million to promote its BNB Treasury strategy.

The broader context is still volatile. Investors are navigating an environment formed by changing commercial policy and geopolitical risk, with the impact of Trump’s reciprocal rates that are expected to enter into force during the third quarter of the year.

Within that backdrop, the relatively stable BNB performance stands out as a continuous demand signal, even if there is a short -term volatility. Cryptocant data shows that within the Exchange tokens sector, BNB is a prominent yield, which has dropped 8.7% from its historical maximum, compared to 35% to 60% for most other tokens.

General description of the technical analysis

The most aggressive price movement occurred during a noon rally that sent to Token up to $ 774.94. The volume increased above 60,000 tokens during that movement, a sign that larger participants may have been promoting the action.

That rally found resistance just below $ 780, where sellers intervened and stopped the advance.

The price action at that level has historically activated reversals, and this session was no exception. A setback followed, with the price finally sliding. While the fall erased a part of the gains of the day, BNB found a constant support near that level.

The repeated defense of the $ 765–766 zone suggests that buyers are accumulating in that range. Institutional interest often appears in this type of layer support, where the price is maintained despite the increase in volume and sales pressure.

The total negotiation range for the session covered $ 16.83, or around 2.18%. Although it is not extreme, this volatility highlights how fast the feeling can turn.