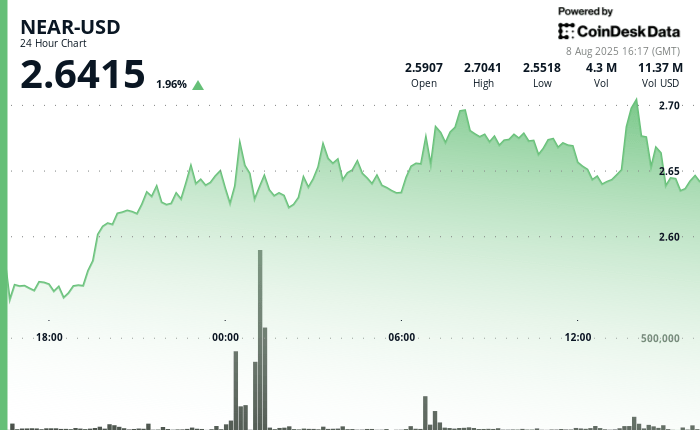

Near the protocol increased 1.93% in 24 hours to 15:00 UTC on August 8, from $ 2.59 to $ 2.64. The Token quoted between $ 2.54 and $ 2.71, a range of 6.84% that industry executives say it highlights the ongoing structural weaknesses in cryptographic markets and the need for a clearer regulation. “These volatile trade patterns highlight the need for a stronger market infrastructure and clearer regulatory frameworks,” said a senior executive from an important digital asset trade firm.

Institutional flows promoted much of the activity, with a volume increasing to 18.9 million units. The analysts pointed out the $ 2.62 to $ 2.66 zone as an approach to corporate treasure bonds and coverage funds. A strong rejection of $ 2.67, accompanied by more than 120,000 units sold in four minutes, reflected the algorithmic trade patterns that have caught the attention of regulators.

Market observers say that the combination of a large institutional purchase and a quick sale shows the sophistication of corporate participation in cryptography, but also raises stability concerns.

Financial metrics and investment analysis

- Near fluctuate within a $ 0.18 band that represents 6.84% volatility between $ 2.54 support and $ 2.71 resistance levels.

- The institutional commercial activity reached its maximum point in 18.9 million units during the hours of the Asian market, exceeding typical corporate trade patterns.

- $ 2.62- $ 2.66 Consolidation attracted corporate investment flows and institutional accumulation strategies.

- The level of $ 2.67 activated systematic sales protocols with more than 120,000 units executed during algorithmic trade sequences.

- The 1.13% decrease in session peaks during the concentrated sales window indicates that institutional risk management protocols remain active.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.