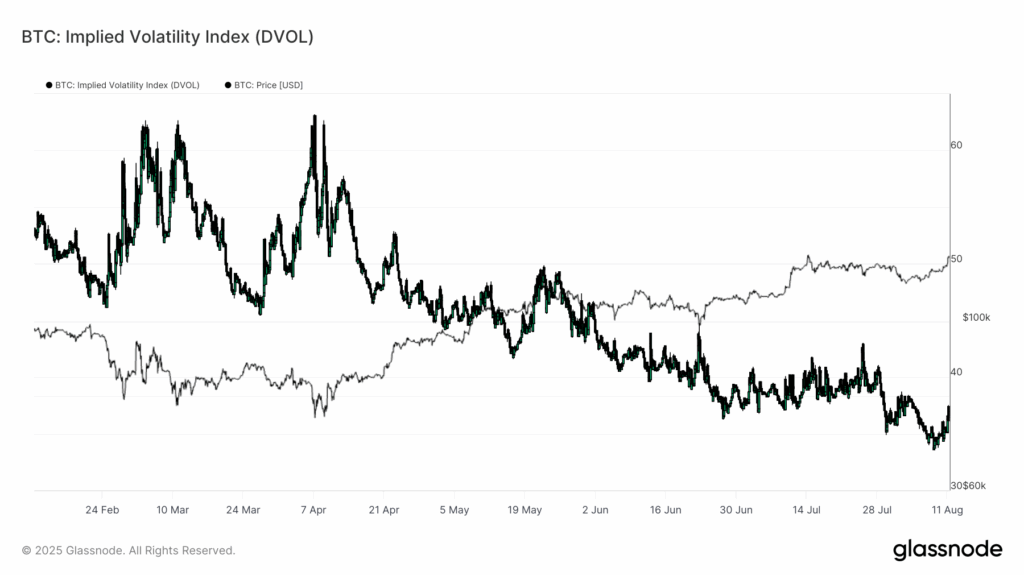

Bitcoin (BTC) Implicit volatility (IV) It moved from 33 to 37 on Monday, a remarkable increase of minimum of several years and a possible sign that the long section of calm on the market is coming to an end.

The Deribit Volatility Index (DVOL)Modeling after VX in traditional markets, it tracks the implicit volatility of 30 days of Bitcoin options and is now at its highest level in weeks.

Implicit volatility represents the prognosis of the market for price swings, calculated from the prices of the options. In formal terms, IV measures the deviation range of a single standard of the expected movement of an asset for a year. Monitoring of money in money (ATM) IV offers a standardized vision of feeling, often increasing and going down next to the volatility performed.

Last week, BTC’s short -term IV fell to about 26%, one of the lowest readings since the options data began to register, before recovering sharply. The last time the volatility sat in this minimum was August 2023, when Bitcoin was around $ 30,000 shortly before a higher acute movement.

During the weekend, Bitcoin increased from $ 116,000 to $ 122,000, insinuating what can happen when volatility begins to expand. August is traditionally a period of low volumes and market activity off, but Rising IV suggests that merchants may be positioning for larger advances ahead.

Checkonchain’s data show that this last rally was a movement driven by the point, which is a healthier market structure than an increase purely fed by leverage. The open interest has decreased until August, which means that a sudden influx of leverage could amplify price changes if the feeling changes.

Read more: Bitcoin Bulls Take another opportunity in the ratio of gold fibonacci above $ 122K as inflation data progresses