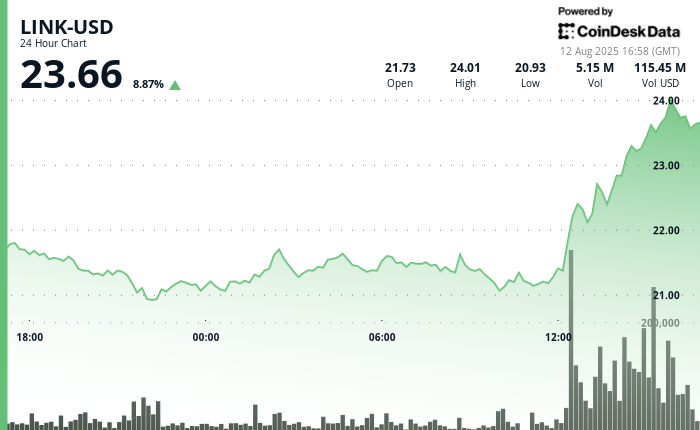

Oracle Service Chainlink’s (LINK) The native token increased 10% on Tuesday to a new height of seven months in the middle of a new association of traditional finance and a recent tokens repurchase initiative.

The Token exceeded $ 24 for the first time since February, extending its 42% rally in a week. That is the biggest gain among the 50 main tokens for market capitalization, according to Coindesk data.

Among the catalysts was a new collaboration between Chainlink and Intercontinental Exchange, the parent company of the New York Stock Exchange, to bring data exchange data and prices of precious metals. The association underlines the expansion of the network as a bridge between traditional finances and blockchain rails.

A tokens purchase program called Chainlink Reserve, announced last week in a blog post, aims to convert the income of Chainlink services and business integrations into link tokens, establishing a boost of persistent purchase.

The technical indicators signal continued backwards

- Link is now quoted above his mobile averages of 50 and 200 days, validating the bullish impulse, he showed the Coendesk market analysis model.

- The short -term resistance arose about $ 24, with a support of around $ 21.00– $ 21.30.

- Relative Force Index (RSI) Measures Approach of overload conditions at 72.72, indicating potential for short -term consolidation.

- A conclusive advance above the resistance zone of $ 24.10- $ 24.13 could trigger the posterior rally phase.

Read more

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.