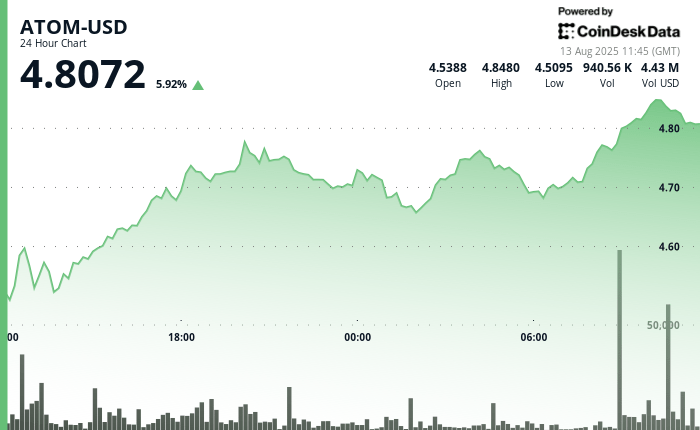

Atom saw an 8% increase of $ 4.49 to $ 4.84 between August 12, 11:00 and August 13, 10:00, backed by a large commercial volume of more than 2 million units, indicating a strong institutional interest. The bullish impulse persisted in the last hour of negotiation, reaching its maximum point at $ 4.85 before consolidating $ 4.83, with a significant volume confirmation that reinforces the rupture above the resistance of $ 4.78. A strong support has been established at $ 4.65, preparing the stage for a possible movement towards the range of $ 4.90– $ 5.00.

During the last hour, Atom increased from $ 4.82 to $ 4.85, an increase of 0.62%, before slightly relieved $ 4.83, a 0.21% drop in the high session. In particular, the level of $ 4.85 was tested and validated by an increase in volume of 24,467 units at 10:20, followed by profits that led to a measured setback. Posterior volume posteros of 47,638 units at 10:44 and 59,892 units at 10:48 during recovery attempts, they underlined continuous institutional commitment, even in the consolidation phases.

The closing minutes saw a minimum activity, which indicates a brief pause at the commercial time. However, the combination of sustained purchase interest, levels of support to increase and decisive resistance violations suggests that the atom is well positioned to continue upwards. With the volume dynamics confirming the upward intention, the asset remains on the way to a potential challenge of the target price of $ 4.90– $ 5.00 in the short term.

The movement occurs when the Bitcoin domain was submerged below 60% for the first time since January, which demonstrates a relative force in the Altcoin sector. However, if Bitcoin can be broken above $ 124,000 and form a new record, Altcoins can slide as capital revolves back to BTC.

Key technical indicators

- Atom exhibited a convincing bullish trajectory with an added range of $ 0.38 (8.52%) During the 23 -hour negotiation period.

- Robust support established at $ 4.65 with a substantial volume confirmation during the recovery phase of 02:00.

- The resistance was materialized compared to $ 4.78, where the price action initially found resistance at 20:00 before achieving an upward advance.

- The notable impulse acceleration occurred during the final hours, particularly at 09:00 with an exceptional volume significantly exceeding the average of 24 hours of 1,148,473 units.

- Technical Breakout corroborated by sustained volume expansion and ascending support formation.

- Successful examination of the $ 4.85 resistance zone with a solid confirmation of volume that precedes the pressure obtaining pressures.

- The volume increases in critical inflection points that confirm institutional participation within the consolidation phase.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.