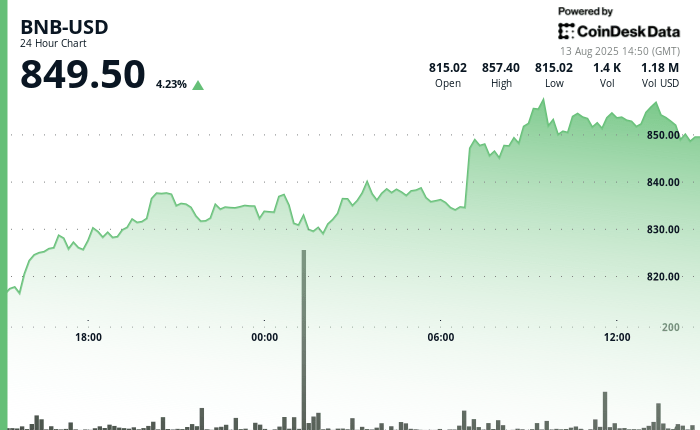

BNB rose more than 4% in the last 24 -hour period in a broader rally in the cryptocurrency market to violate the $ 850 mark and about its historical maximum of $ 860.

The Token increased from $ 813.90 to its maximum during the session, breaking key resistance points at $ 839.57 and $ 853.67 before complying with the sales pressure near the psychological level of $ 855, according to the technical analysis model of Coindesk Research.

The rally won impulse after CEA Industries acquired 200,000 BNB, becoming the largest corporate headline in the asset. The measure is part of a growing trend of companies that add alternative cryptocurrencies to their reserves.

The commercial volume shot almost three times its daily average, feeding the optimism that institutional purchase could maintain an upward impulse. However, prices withdrew slightly in the final part of the session, which suggests a possible short -term consolidation.

General description of the technical analysis

Market data showed a strong purchase interest through the rally, with a great commercial activity that establishes solid support about $ 834.40. The BNB advance cleared the resistance to $ 839.57 and $ 853.67, and prices remained higher than $ 850 during most of the period, a sign that the accumulation remained at stake even when the impulse began to cool.

The peak of the rally coincided with an increase in the sales orders, hinting at the profits that slowed down the impulse beyond the $ 855. That sales pressure created a bearish divergence towards the closure, where the Token could not recover a higher land.

The largest cryptographic market, measured by Coendesk 20 (CD20) Index, increased 5.3% in the last 24 -hour period. BNB has continued to be the dominant token in the exchange tokens sector, according to cryptocancy data, which represents more than 81% of its total market capitalization. It is about 1% of its record record, while the second best Leo exchange token remains around 8% of it.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.