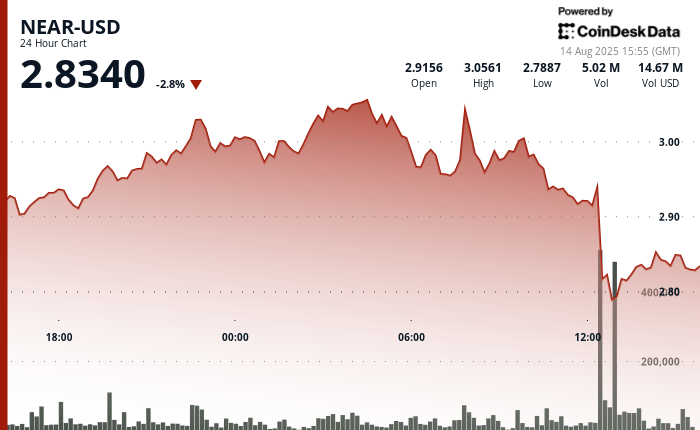

Near the protocol saw a greater volatility in the 24 hours that end on August 14 at 2:00 p.m. UTC, with prices that fluctuate between $ 2.78 and $ 3.05 before solving $ 2.82.

The decrease in resistance of $ 3.0 to a $ 2.75 support was driven by a strong institutional sale, for a total of almost 20 million tokens during maximum pressure. Despite this, the foundations of the asset are still strong, backed by a considerable active user base of 16 million weekly participants.

In the hour after sale of the sale, 0.35% was earned to $ 2.83, which is quoted within a controlled range of $ 0.07 between $ 2.81 and $ 2.85. The key institutional purchase appeared at several intervals, which helped the short -term resistance of the token at $ 2.83– $ 2.84 and reaching session maximums of $ 2.85.

The negotiation volume decreased to approximately 100,000 tokens per minute, which suggests accumulation instead of speculative retail activity, with a preliminary support that is formed about $ 2.81– $ 2.82.

Market performance indicators reflect mixed corporate perspectives

- The nearby protocol recorded substantial price volatility with a negotiation range of $ 0.26 that represents a movement of 8.53% between the maximum of the $ 3.0 session and the minimum of $ 2.78.

- The cryptocurrency initially demonstrated an upward boost from $ 2.90 to reach $ 3.0 during the night negotiation hours, establishing technical resistance to the level of $ 3.04- $ 3.05.

- The significant institutional sale occurred during August 14 between 12: 00-13: 00 UTC with exceptional commercial volumes of 19.99 million and 12.22 million tokens respectively.

- The daily commercial activity substantially exceeds the average of 24 hours of 5.47 million tokens, which reflects a greater institutional sales pressure.

- The market price decreased to $ 2.75 before corporate purchase interest supports a recovery to $ 2.82 at the close of the session.

- According to market strategists, high -volume institutional sales patterns suggest continuous risk potential despite the modest recovery attempts, according to market strategists.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.