For more than a decade, the mantra for Bitcoin headlines has been clear: “Not your keys, or your coins.” But as Bitcoin matures in an asset recognized worldwide, that mentality is no longer enough for whales that handle hundreds of millions in BTC. The recent movement of more than 80,000 BTC of eight wallets of the Satoshi era, the greatest transfer of this type in the history of Bitcoin, has revived attention to how inherited headlines handle and eventually relax vast positions. Keeping the Bitcoin spot directly, especially in large quantities, it exposes investors at an avoidable risk, operating headaches and regulatory friction, not to mention the type of custody nightmares that can even keep the headlines most experienced at night.

There is an alternative in the form of regulated Bitcoin exchange products (ETPs), a proven equity structure with a solid history. The physically supported cryptographic ETP have been available in Europe for more than seven years. These products combine transparency and safeguards of traditional markets with digital asset innovation, offering stronger security frameworks, greater access to liquidity, fiscal and compliance efficiencies and the ability to use them as collateral for loans. For the big headlines, the case to move to regulated wraps is becoming too strong to ignore.

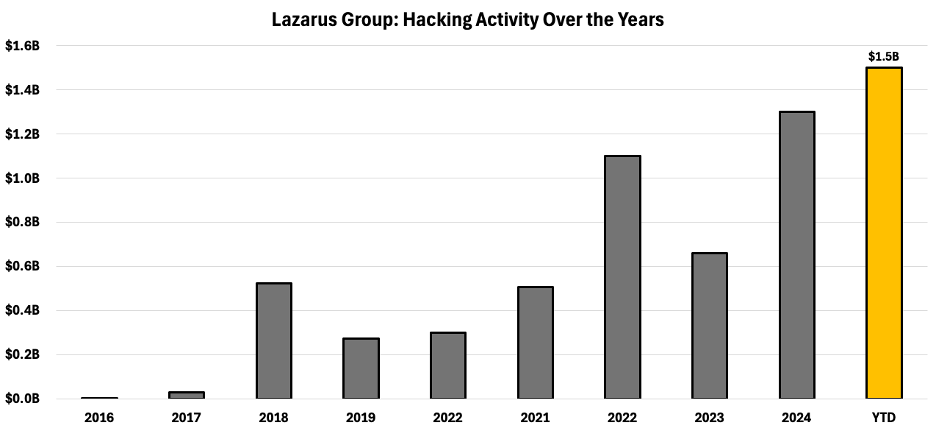

Liquidity is a great concern. The great headlines who want to relax a position often face a significant slip and a risk of counterpart in centralized exchanges. Alternatively, they must designate external companies to administer the process, triggering time delays due to the incorporation and KYC and, often, paying a premium in the execution. With an ETP, administrative obstacles are loaded with frontal; Once incorporated, the investor has access to the ETP liquidity group, simplifying and accelerating output strategies when time is important. Many whales believe that Autocustody maximizes security. Actually, the management of large specific positions is incredibly complex. Key management, cold storage logistics, succession planning and internal controls require infrastructure that few people, or even crypto-national funds, can maintain safely. Regulated ETPs avoid this completely offering professionally administered custody solutions, combining segregated accounts, insurance coverage and direct supervision of financial regulators. European structures go further with remote frames in bankruptcy and the legal title of the underlying BTC. It is not about giving up the property, in fact, it is an update of how that property is maintained: safely, transparently and with institutional degree safeguards to avoid losses and fraud. For example, the Lazarus Group, one of the most notorious piracy organizations in North Korea, has been responsible for a significant number of infractions related to cryptography, resulting in the theft of $ 1.5 billion only this year.

Figure 1: Total Crypto-Hacks Value in USD in recent years

Source: Analysis chain

European ETPs allow transfers in kind that allow investors to move Bitcoin directly inside and outside the bottom without triggering an taxable event. This is especially valuable in jurisdictions such as Switzerland and Germany, where long -term holders can optimize capital gains treatment. For long -term whales thinking, the flexibility of flow in kind is an important update. It also unlocks a new financial option; Instead of selling your bitcoin during an important event of life, such as buying a house, investors can borrow against their ETP holdings and access liquidity without separating from the underlying asset and triggered capital gains.

Autocustody will always have a place, especially for users in unstable regions or for those who need financial sovereignty. But for scale whales, BTC maintenance compensation are increasingly difficult to justify. Bitcoin ETPs are simply less headache: they reduce risk, improve access to liquidity, simplify compliance and offer long -term infrastructure for serious capital allocators, allowing large investors to sleep easily at night. The future of Bitcoin’s property is not about can hold your keys, it’s about if ought.