A year ago today, the markets were shaken by Yen’s relaxed trade. As Japan changed to a more strict monetary policy and the bond yields increased, the strategy of borrowing in a low interest currency such as Yen to buy higher performance assets became less attractive.

At that time, capital fled quickly from risk assets. Bitcoin (BTC) fell sharply, falling almost 30% to $ 49,000, a level previously seen at the time of the US spot ETF ETF. UU. Debuts in January 2024.

Since then, however, the largest cryptocurrency for market capitalization has recovered strongly, gathering more than 130% in the last year. Traditional markets also worked well, with the S&P 500 increasing 24% and gold appreciating 40%, reflecting the growing demand for risk and defensive assets.

On the contrary, the dollar index (DXY), an American currency meter against a pairs basket, has weakened just under 100 of 103 as the returns of the long date bonds rise. The 10 -year performance of the USA increased to 4.2% from 3.7%, while 30 years increased to 4.8% of 4.0%. The changes were amplified by international interest rate movements, with the 30 -year performance of the United Kingdom to 5.3% of 4.3% and Japan rises to more than 3% of 1.9%.

Despite the price volatility, long -term Bitcoin holders have constantly increased their participation in the supply.

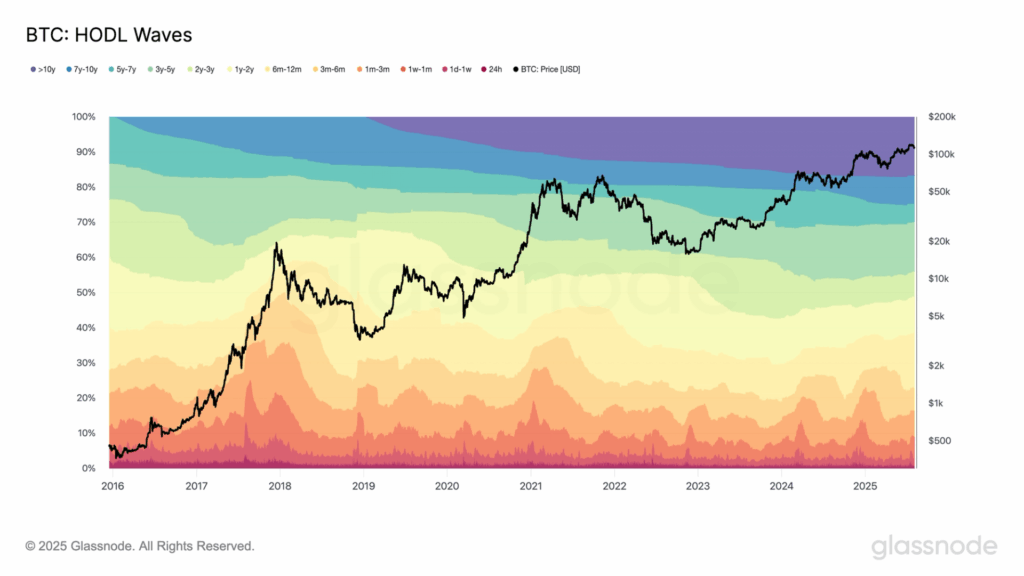

According to the Glassnode Hodl wave table, which visualizes the distribution of Bitcoin’s supply by age, each color band represents the percentage of BTC in existence that moved for the last time within a specific time range. The bands collectively show how long coins have been carried out, offering information on investor behavior and conviction over time.

The cohort of 7 to 10 years now has more than 8%, compared to 4% a year ago, while the holders of 6 to 12 months have increased from 8% to 15%. This suggests that long -term holders remain safe and still accumulate, while the newest investors entered the market during the rally.

While sub-3 months holders now have a higher percentage of supply than in 2024, which indicates that many buyers have probably entered at higher prices, possibly chasing tops instead of buying the minimums.