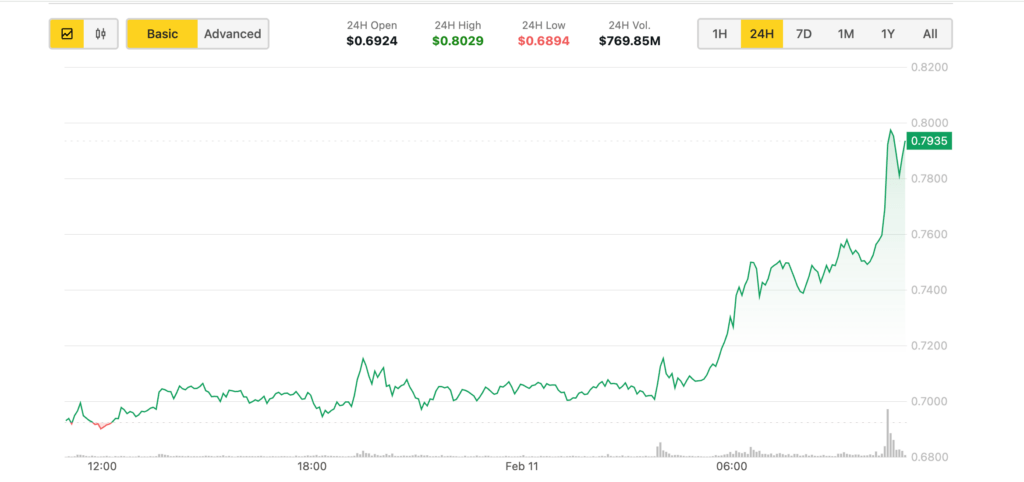

Cardano’s token increased 11%, surpassed Bitcoin (BTC) and Ethher (ETH), after investments in the gray scale will be applied to the first quoted fund (ETF) in the United States in the US .

Ada rose to 80 cents, with the movement starting on Wednesday night, according to Coindesk data. However, the ninth largest cryptocurrency per market value has still dropped 36% since its maximum of December around $ 1.37.

Grayscale, an outstanding cryptographic asset manager, appeared to list the first Ada Spot Fund in the New York Stock Exchange. An ETF Spot would allow investors to obtain exposure to cryptocurrency without having to have it directly.

The Bitcoin and Ether Spot ETF began operating in the United States last year, attracting billions of investor funds since its inception and reinforcing the narrative of institutional adoption.

Keep in mind that the approval of the US SEC of Spot BTC and ETH ETFS was mainly based on the assumption that the CME surveillance system for Bitcoin and Ether futures would mitigate concerns about price manipulation. In other words, CME futures have been a previous requirement to obtain the Spot ETF approval. The giant of global derivatives has not yet listed Ada’s futures.

The market does not seem worried about that, as evidenced by Ada prices.

Focus on layer 1 coins

The cryptocurrency and its co -1 partners such as BTC, Eth, Sun and others could remain well supported in the next few days, since the talk of social networks suggests a change in the bias of the investors of the memecoras to the coins of the Capa 1, according to the Santiment analysis firm.

“The cryptographic community has largely changed its attention to Bitcoin and other assets of layer 1 such as Ethereum, Solana, Toncoin and Cardano. Collectively, the main assets of layer 1 are obtaining 44.2% of the discussions between specific currencies. Shiba Inu and Pepe are being discussed less and less on social networks, “said Santiment in X.

“A change in the attention of the merchant of Memes currencies to Bitcoin assets and Layer 1 is generally a sign of a more stable and sustainable market environment,” Santiment added.

BTC in stasis

Bitcoin continues to exchange a mediocre between $ 95,000 and $ 100,000, with the probable rise for the fears of the commercial war and the increase in inflation expectations in the Ether of the USA. UU., The second largest token for market value , has been blocked between $ 2,500- $ 2,900 since it recovered from the accident last Monday until last Monday to $ 2,000 in several exchanges.

Macro merchants have recently turned to gold, sending the price of yellow metal at all times greater than $ 2,900 per ounce.

Some analysts said Bitcoin will have the last laugh.

“The recent decrease in volatility, together with the increase in the price of gold, should highlight Bitcoin’s growing attraction as an alternative value reserve. Despite short -term fluctuations, Bitcoin’s fundamental narrative remains intact, with the Increased institutional interests and their positioning as a potential possession of the roof against inflation and the devaluation of currency that continue to support their long -term potential, “Bitfinex analysts said.

“A change [away from gold] It can be underway. More than $ 196 billion in Bitcoin is now in the hands of ETF, public and private companies, and even national states. With the central banks that expand the money supply and the risks of fiduciary devaluation, Bitcoin’s fixed supply narrative is becoming increasingly attractive, “analysts added.