By Francisco Rodrigues (All Times et unless indicated otherwise)

The global markets are treading water while investors wait in the last policy movement of the Federal Reserve, which will arrive later today. It is almost a certain that Fed will reduce interest rates by 25 basic points. Instead, merchants will focus on President Jerome Powell for signals on future policy.

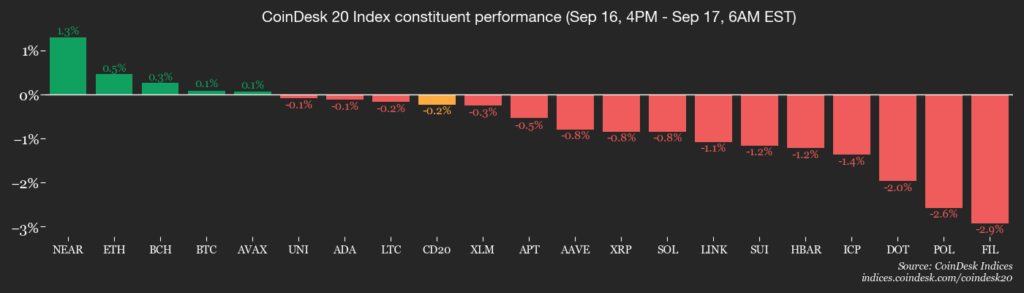

The cryptocurrency market is no different. In the last 24 hours, the Coendesk 20 (CD20) index practically does not change, only 0.2%, while Bitcoin (BTC) is around 1% higher. Gold, which increased to a $ 3,700 record this week, fell 0.5%. The US dollar index added less than 0.2%.

Variable rental markets have barely moved. US actions fell into yesterday’s session, while European actions are higher. The FTSE All-World index advanced less than 0.1% today.

That is today. But for a longer period, cryptocurrencies have been left behind the actions.

In the last 30 days, the FTSE All-World index increased 2.78%, while Coendesk 20 added 2.6%and BTC won 1.6%. The movements suggest caution even before the reduction of the rate that would increase the appeal of risk assets.

Investors are currently staring at six interest rate cuts. Three this year, and three next year.

“Market expectations are placed in a range of Goldilocks: six cuts represent a midpoint between precaution and aggression,” QCP capital analysts wrote in a note.

“However, a deviation in the DOT plot would challenge that balance, which forces investors to emphasize around the risk of strictest conditions than expected or a Fed that struggles to respond effectively to the weakest growth,” the analysts added.

The real market test will be Powell’s press conference. It is likely that a balanced message further supports risk assets, while doubt would force investors to reassess.

Despite uncertainty, the demand of Criptographic ETF spot has remained robust. This week, net tickets for ETF Spot BTC are around $ 550 million, while spot Ether ETF brought almost $ 300 million. Stay alert!

What to see

- Crypto

- Nothing scheduled.

- Macro

- September 17, 9:45 AM: Canada Reference Interest Decision Est. 2.5% followed by a press conference.

- September 17, 2 in the afternoon: Fed decision on the interest rates of the United States, including updated projections of the Dot plot. Est. 25 BPS cut at 4.00%-4.25%, followed by a press conference.

- September 17, 5:30 pm: Brazil Reference Interest Rate decision Est. 15%.

- Earnings (Estimates based on data data)

- None scheduled.

Token events

- Government votes and calls

- Mantledao votes to keep the budget 2025-2026 at $ 52 million of USDC and 200 million MNT. The vote ends on September 18.

- September 17, 6 AM: DyDX to organize an analyst call.

- You unlock

- September 17: Zksync (ZK) will unlock 3.61% of its circulating supply for a value of $ 10.54 million.

- Lanza Token

- September 18: Deadline for converting MKR to Sky before the penalty of delayed update enters into force.

Conferences

- Day 2 of 2: Real World Assets Summit (New York)

- September 17: Bitcoin NYC Treasures Distrust (New York)

- Day 1 of 3: AIBC 2025 (Tokyo, Japan)

Token talk

By Oliver Knight

- Bitcoin (BTC) continues to stubbornly exchanged in a narrow range, slightly increasing to $ 116,000 in the last 24 hours, but not increasing the impulse for a break.

- The Altcoins are taking advantage of the lack of volatility with several peaks that lead to Bitcoin’s domain from sliding to a minimum of eight months of 57%, according to CoinmarketCap data.

- Domain is a metric commonly used to assess whether capital flows to Bitcoin or more speculative altcoins, as is the case.

- Another bullish factor for Altcoins is that the average Cryptographic Token RSI, an abbreviation for the relative force index, is 45.47. This means that alternative alternatives are getting into “overendon” territory instead of “overcompra”, suggesting that several tokens are prepared for upward extension.

- It is worth noting that Bitcoin’s domain fell to 33% in 2017 and 40% in 2021, which means that Altcoins still has more space to run.

- Much will depend on how Bitcoin acts if you start trying maximum records at $ 124,000. A rupture in a significant volume will probably lead to capital rotation to the largest cryptocurrency as investors try to capitalize on a high potential cycle, with personalities such as Eric Trump asking for $ 175,000 before the end of the year.

Derivative positioning

- The open interest of BTC Futures in the main places has increased up to $ 32 billion during the past week.

- At the same time, the three-month-old annualized base has begun to compress again at approximately 6-7% between Binance, OKX and Deribit, leaving the transport trade only marginally profitable.

- While OI’s growth suggests a growing activity and participation in the market, the narrowing base indicates that the directional conviction, particularly on the upward side, is weakening, and merchants less willing to pay a high premium for the future exhibition.

- The options data also present a complex image of the feeling of the market.

- While the BTC implicit volatility term structure table shows a upward inclination curve, which suggests that the market expects long -term volatility to be higher than in the short term, other metrics point to a more immediate bearish perspective.

- Specifically, the 25 Delta bias table indicates that bias is flat or slightly negative for short -term options (1 week, 1 month), which means that merchants are paying a premium for calls to obtain protection against decreases.

- This short-term bassist feeling is contradicted directly by the volume graph of 24-hour Putt-Llame calls, which shows a greater volume of calls than the puts, which indicates that in the last 24 hours, most of the options were positioned for a price increase.

- The APrs financing rate in the main places of perpetual exchange has recently begun to show some collection with annualized BTC funds currently 17%.

- If the upward trend is maintained and followed by other places, financing rates would suggest a growing conviction in a directional and more bullish commitment of prices.

Market movements

- BTC has dropped 0.22% of 4 PM ET on Wednesday to $ 116,637.44 (24 hours: +1.01%)

- ETH has not changed to $ 4,498,24 (24 hours: +0.00%)

- COINDESK 20 has dropped 0.58% to 4,272.21 (24 hours: +0.1%)

- The commitment rate composed of CESR Ether Cesr has dropped 2 PB to 2.86%

- The BTC financing rate is at 0.0077% (8,4589% annualized) in Binance

- DXY has risen 0.14% to 96.76

- Gold futures have dropped 0.52% to $ 3,705.60

- Silver futures have dropped 2.14% to $ 42.00

- Nikkei 225 closed 0.25% to 44,790.38

- Hang Seng closed 1.78% to 26,908.39

- FTSE increases 0.20% to 9,213.65

- Euro Stoxx 50 has increased 0.11% to 5,377.98

- Djia closed 0.27% to 45,757.90 on Tuesday

- S&P 500 closed 0.13% to 6,606.76

- Nasdaq compound without changes at 22,333.96

- The S&P/TSX compound closed 0.39% to 29,315.23

- S&P 40 Latin America closed 0.52% to 2,919.60

- The 10 -year Treasury rate of US has dropped 1 bp to 4,016%

- E-mini s & p 500 futures have not changed to 6,669.00

- E-mini nasdaq-100 futures have not changed to 24,525.25

- The average E-mini Dow Jones Industrial has not changed to 46,146.00

Bitcoin statistics

- BTC domain: 58.3% (no changes)

- Ether-bitcoin ratio: 0.0386 (0.15%)

- Hashrat (seven -day mobile): 1,021 eh/s

- Hashprice (spot): $ 54.43

- Total rates: 4.18 BTC / $ 483,499

- CME Future Open Interest: 144,220 BTC

- BTC with a gold price: 31.8 oz.

- BTC vs Gold Market Cap: 8.91%

Technical analysis

- Bitcoin has increased from $ 107K to $ 117K, now quoting above all key exponential mobile averages.

- Despite this force, the broader bias is still cautious.

- In order for the impulse to continue, the Bulls will seek a decisive claim of the daily orders block between $ 117K and $ 119K, an area that also aligns with the weekly orders block established in early August.

Cryptographic equities

- Global Coinbase (COIN): closed on Tuesday at $ 327.91 (+0.27%), -0.52% at $ 326.19 in the previous market

- Circle (CRCL): closed at $ 134.81 ( +0.57%), +1.07% at $ 136.25

- Galaxy Digital (GLXY): Closed at $ 31.83 (+3.44%), -1.35% at $ 31.40

- Bullish (BLSH): closed to $ 51.36 (+0.55%), -0.35% at $ 51.18

- Mara Holdings (Mara): closed at $ 17.53 (+7.94%), -0.34% at $ 17.47

- Riot Platforms (Riot): closed at $ 17.52 ( +5.04%), +0.23% at $ 17.56

- Core Scientific (Corz): closed at $ 16.18 (-0.86%), without changes in the previous market

- CleanSTark (CLSK): closed to $ 11.20 (+8.84%), without changes in the previous market

- COINSHARES VALKYRIE BITCOIN MINERS ETF (WGMI): closed at $ 39.86 (+2.92%), -1.15% at $ 39.40

- Exodus movement (exod): closed at $ 29.70 (+6.53%), -1.11% at $ 29.37

Crypto Treasury Companies

- STRATEGY (MSTR): closed at $ 335.09 ( +2.23%), +0.21% at $ 335.80

- Semler Scientific (SMLR): closed at $ 29.11 (+2.54%)

- Sharplink Gaming (SBET): closed at $ 16.95 (+0.95%), without changes in the previous market

- UPEXI (UPXI): closed at $ 5.82 (-8.06%), +3.09% at $ 6

- LITE STRATEGY (LIT): Closed at $ 2.69 (-7.56%), +10.43% at $ 3.07

ETF flows

Spot BTC ETFS

- Daily net flows: $ 292.3 million

- Cumulative net flows: $ 57.34 billion

- Total BTC holdings ~ 1.32 million

Spot Eth Ethfs

- Daily net flows: -$ 61.7 million

- Cumulative net flows: $ 13.68 billion

- Total eth holdings ~ 6,61 million

Source: Farside Investors

While you sleep

- Metaplenet establishes the US subsidiaries. UU., Japan, buy the name of Bitcoin.jp domain (Coindesk): The sixth largest BTC Treasury company in the world formed Bitcoin Japan to execute media platforms centered in bitcoin and the entrance of Metaplanet based in the US. UU. To generate income of financial products related to Bitcoin.

- 21Shares hits 50 ETP of cryptography in Europe with the launch of AI and Raydium -centered products: 21Shares introduces two products quoted in cryptographic exchange (ETPs), one that tracks a group of decentralized the protocols of decentralized and another that offers exposure to the token of Decantralized Raydium based on Solana.

- Hex Trust adds custody and rethinking for Lido’s Steth, expanding institutional access to Ethereum Rewards (COINDESK): The company’s unique betting feature characteristic allows customers to access reference rewards and liquidity tools of decentralized finance (defi) for Steth without establishing their own infrastructure.

- Three things that Great Britain wants from Trump’s state visit, apart from business (CNBC): the United Kingdom wants Trump’s visit to advance the unfinished commercial agreement, address obstacles such as steel and aluminum tariffs and Blackrock, Alphabet and Blackstone investment.

- The Guardian dog of the United Kingdom will renounce some rules for Cryptoasset (Financial Times) suppliers: the FCA says that it will adapt the regulations to the unique risks of Crypto, promising more strict safeguards on technology and resistance when exploring if investors should obtain protections from broader consumers.