Islamabad:

The Minister of Finance, Muhammad Aurengzeb, presented on Tuesday a budget of RS17.6 billion, which tried to limit fiscal expansion, but fiscal measures were clearly self -contracting that, on the one hand, would promote the cash economy and fossil fuels, but also discouraged them in the other.

The government of Prime Minister Shehbaz Sharif also introduced new taxes on digital economy, pensioners and clean energy. Some of these measures were contradictory to the declared policy to discourage the cash economy. However, the 2025-26 finance bill also gave incentives for clean energy by taxing internal combustion motor cars and fossil fuels.

Despite high poverty and high unemployment, the government proposed drastically reduce the import tariffs of raw materials to finished products, what the industry feared would lead to the deindustrialization of Pakistan.

The economy has opened for foreign competition by reducing the protection available for local industries. The Minister of Finance said that the maximum custom of us has been reduced to 15%, while there had been a five -year plan to abolish additional and regulatory duties.

The inaudible budget discourse, which Aurangzeb, pronounced in the midst of the noisy opposition, clearly lacked a policy address. Although the Finance Division tried to meet the requirement of the International Monetary Fund (IMF) to meet the fiscal objectives, the Federal Income Board (FBR) could not find the clear tax policy.

The 2025-26 finance bill seemed to be the most confusing document that any government produced in years. He revolved around the economy of young people and commercial practices of the 21st century.

The Government has proposed a 18% sales tax on the importation of solar panels, but imposed RS2.5 per liter of carbon collection in the use of gasoline, diesel and baking oil, which shows the lack of clarity by the government.

Similarly, the cash withdrawals of banks increased from 0.6% to 0.8% to discourage the cash economy and generate more easy money, but also imposed a new tax on digital service platforms in the range of 0.25% to 5%.

The Government also increased the sales tax of 850 cc of the middle class from 12.5% to 18%. A new tax on pensioners has been introduced where the monthly pension of RS833,000 has been taxed at a rate of 5%.

Once again, the FBR was missing politics, if the government wanted to promote the digital economy or the cash economy. The president of FBR, rashid langial, canceled the media conference on the Finance Law 2025-26, which was equivalent to compromising the transparency and right of people to know the measures that affect their futures.

In his budget speech, the Minister of Finance, surprisingly, declared that “rapid growth in business and online digital market was creating problems for traditional companies, therefore, it is proposed that electronic commerce platforms, emails and logistics services should taxes at a rate of 18%.

A fiscal official told the Express PAkGazette that the FBR would win RS64 billion to tax the digital economy. The 2025-26 finance bill showed that economic managers preferred the nineteenth-century economy by providing a certain relief in the purchase of properties, but taxed the digital platforms of the 21st century.

It has also proposed to prohibit the economic transactions of non -eligible people, which include the prohibition of the purchase of properties, cars and investments in values by people whose assets do not coincide with these purchases.

Through the financial bill, the Government also modified a large number of other laws that are not taxes, in addition to presenting two new laws, the Digital Presence of Presence 2025 and the new Law on Collection of Adoption of Energy Vehicles, 2025. There may be constitutional questions, if the new laws may be presented through the Financial Law Project.

The Government has proposed a total of more than 415 billion million fiscal measures in the budget, said the senior fiscal official. These include measures related to RS292 billion measures related to FBR, RS111 billion additional profits when imposing RS2.5 per liter of carbon collection in gasoline, diesel and baking oil and rupee values of RS9 billion in conventional cars.

The Minister of Finance, Aurengzeb, said that the IMF had also accepted the compliance measures of RS389 billion worthwhile. But he admitted that the relationship imposed on GDP of the FBR would remain below the objective of the IMF of 10.6% in this fiscal year.

The Government has proposed these measures to extract a minimum of RS2.2 billion from the slow economy in an attempt to achieve the fiscal objective of RS14.13 billion RS14.13 billion of next fiscal year. The objective of oil and carbon tax has been established in RS1.47 billion for the next fiscal year in the back of RS80 per liter.

The Minister of Finance also announced a respite for salaried persons of the lower income group. He said that in the annual income of RS1.2 million, the tax rate will be 2.5%, below 5%.

At the Cabinet meeting before, there was an exchange of words between the Minister of Finance and the Minister of Communication Abdul Alaeem Khan, who had asked the prime minister to further increase wages for government employees.

On that, the Minister of Finance declared that this would require additional resources, which led Khan to say that he was not a street seller, who did not know that this required additional money, said a member of the Cabinet on condition of anonymity.

The prime minister decided that to give a 10% increase in wages, the tax rate for the lower average income group should be increased from 1% proposed to 2.5%, the sources said.

In the annual income of up to RS2.2 million, the government has proposed to reduce the rate from 15% to 11%, in the annual income of RS3.2 million, the rate is reduced from 25% to 23%. There is no relief for annual salaried income of more than RS4.1 million. However, the finest income has been reduced from 10% to 9%, what the finance minister called was necessary to stop the “brain leak.”

The anticipated tax on the sale or transfer of real estate has increased from 3% to 4.5% on the value of the property of RS50 million. The rate rises to 5% of 3% in the property of RS1 billion, while increases even more to 5.5% from 4%, if the value exceeds RS1 billion.

However, in the purchase of the property, the rate is reduced from 3% to 1.5%, from 3.5% to 2% and 4% to 2.5%, depending on the value of the property. The economic transactions of non -eligible people have been prohibited if the value of new purchases is more than 130% of the value of total assets.

Tight fiscal path

To remain in the IMF program, the Government has proposed a fiscally adjusted budget, although it also created space for political spending. The Government has proposed a budget deficit of RS6.5 billion or 5% the size of the economy.

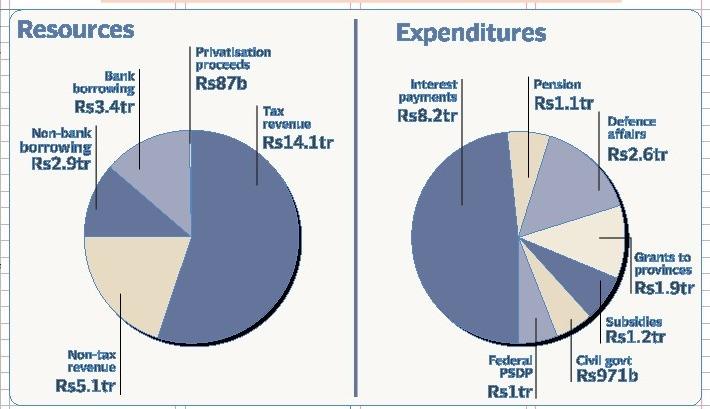

The total budget size is RS17.6 billion, which is 7.3% less than this year’s original budget due to relatively lower allocations for interest payments in fiscal year 2025-26.

The proposed budget deficit is 1.8% of GDP or RS2.4 billion less than the original estimates of this fiscal year. The deficit may still seem large in absolute terms. But it is, for the first time, lower than this year’s gap, both in terms of the size of the economy and in absolute numbers.

The defense budget has been proposed at RS2.55 billion, which is 21% or RS436 billion higher than this fiscal year due to the war with India. The Armed Forces Development Program has increased marginally to RS300 billion, which is much lower than the military had demanded.

The Government is projecting gross federal income in the RS19.3 billion registry for the next fiscal year, higher in RS1.5 billion.

Gross income is based on the fiscal objective of the FBR of RS14.13 billion and income without taxes of RS5.2 billion. Income without taxes will come mainly from the oil tax where the government wants to raise almost RS1.5 billion and the gain of RS2.4 billion by the State Bank of Pakistan.

Of the RS14.1 Tax Collections of FBR, the provinces will obtain RS8.2 billion as their actions in federal taxes under the Prize of the National Finance Commission (NFC).

This leaves the federal government with RS11 Billions of net income for the next fiscal year, which will not be enough to comply with interest payments and include all defense expenses. The government will borrow RS6.5 billion in the next fiscal year to finance the total federal budget of RS17.6 billion total.

According to the IMF program, the four provinces must also save RS1,46 billion of their income as cash surpluses to reduce the national budget deficit to RS5 billion or 3.9% of GDP. This is a more pronounced fiscal consolidation and would require that the five governments meet all their objectives related to income and expenses.

Interest payments will eat 47% of the budget and the net income of the federal government, after paying provincial actions, will be RS2.8 billion more than interest payments. The interest payments of next year are estimated at RS8.2 billion, which is lower than this fiscal year due to the substantial reduction in interest rates.

The finance minister announced a BISP program of RS716 billion aimed at expanding the network to more than 10 million beneficiaries and add more children in conditional cash transfer programs.