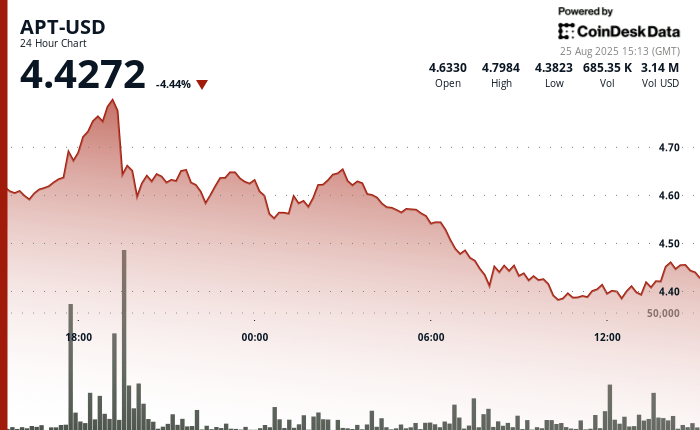

The Apt of Aptos fell 4% during the 24 -hour negotiation period, fluctuating within a range of 10%, according to the technical analysis model of Coindesk Research.

The Token made a $ 4.80 session and a minimum of $ 4.38, initially advancing to $ 4.80 before decreasing considerably to $ 4.43 for the morning hours, then consolidating around $ 4.45 with modest recovery indicators at the final negotiation time, the model showed.

A significant support backed by volume materialized around the price zone of $ 4.38- $ 4.41, where the institutional purchase arose, with the final time demonstrating an impulse of recovery around $ 4.45, which suggests a potential market stabilization after the decrease of 9% of peak to minimum, according to the model.

The fall in APT occurred when the broader cryptographic market also fell, with the broader market meter, Coindesk 20, 3.2%less.

In recent negotiation, Aptos was 3.7% lower in 24 hours, quoting around $ 4.43.

In the news front, the digital wallet Expo2025, promoted by apt, had half a million new accounts and 4.4 million transactions, according to a recent publication on X. Meanwhile, the defi Aave loan protocol was recently launched in suitable. This marked the first implementation of AAVE in a non -EVM (Ethereum virtual machine) compatible blockchain.

Technical analysis:

- Exceptional negotiation volume of 6.6 million during the 7:00 p.m. compatible with the initial rally, followed by a sustained volume support around $ 4.38- $ 4.41 Price zone.

- Clear ascending channel formation with successive levels higher than $ 4.39, $ 4.42 and $ 4.45 during the recovery phase.

- Three different manifestations of volume during the rupture of the final hour above the resistance level of $ 4.41.

- The strong institutional purchase interest arose in an area of $ 4.38- $ 4.41, establishing key support after 9% decrease in the peak.

- The next level of psychological resistance was identified at $ 4.50 after a successful rupture above $ 4.41.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.