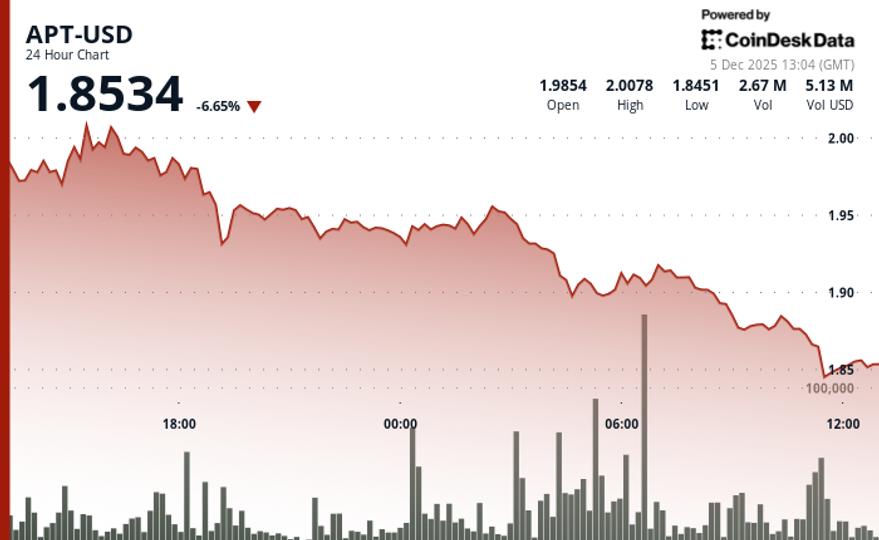

weakened sharply during Friday’s session, falling 6% to $1.85 as technical selling overwhelmed buyers.

The token lagged compared to the broader crypto market, with the CoinDesk 20 index down 2.5% at press time.

Trading volume remained moderate at just 10.8% of the 30-day average, suggesting that the APT decline lacks broad participation, according to CoinDesk Research’s technical analysis model.

The model showed that Aptos created a trading range of $0.17 representing 8.5% volatility as multiple waves of selling pressure set new session lows.

The recent price action shows signs of stabilization.

The token formed a possible double bottom pattern near $1,842, suggesting that institutional buyers have emerged at these depressed levels, according to the model.

This constructive development provides the first technical positive after days of persistent weakness, according to the model.

Technical analysis:

- Double bottom support remains at $1.842, with psychological resistance at $1.90 and a breakout level at $1.87 now acting as general supply.

- The large selling volume of 3.54 million confirms the legitimacy of the breakout, while the subsequent light volume suggests reduced selling pressure.

- Break of the descending trend line completes a drop from the $0.17 range with a double bottom formation indicating a potential bottom

- Immediate resistance points to previous support at $1.87 with downside exposure to $1.80 if the double bottom fails.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.