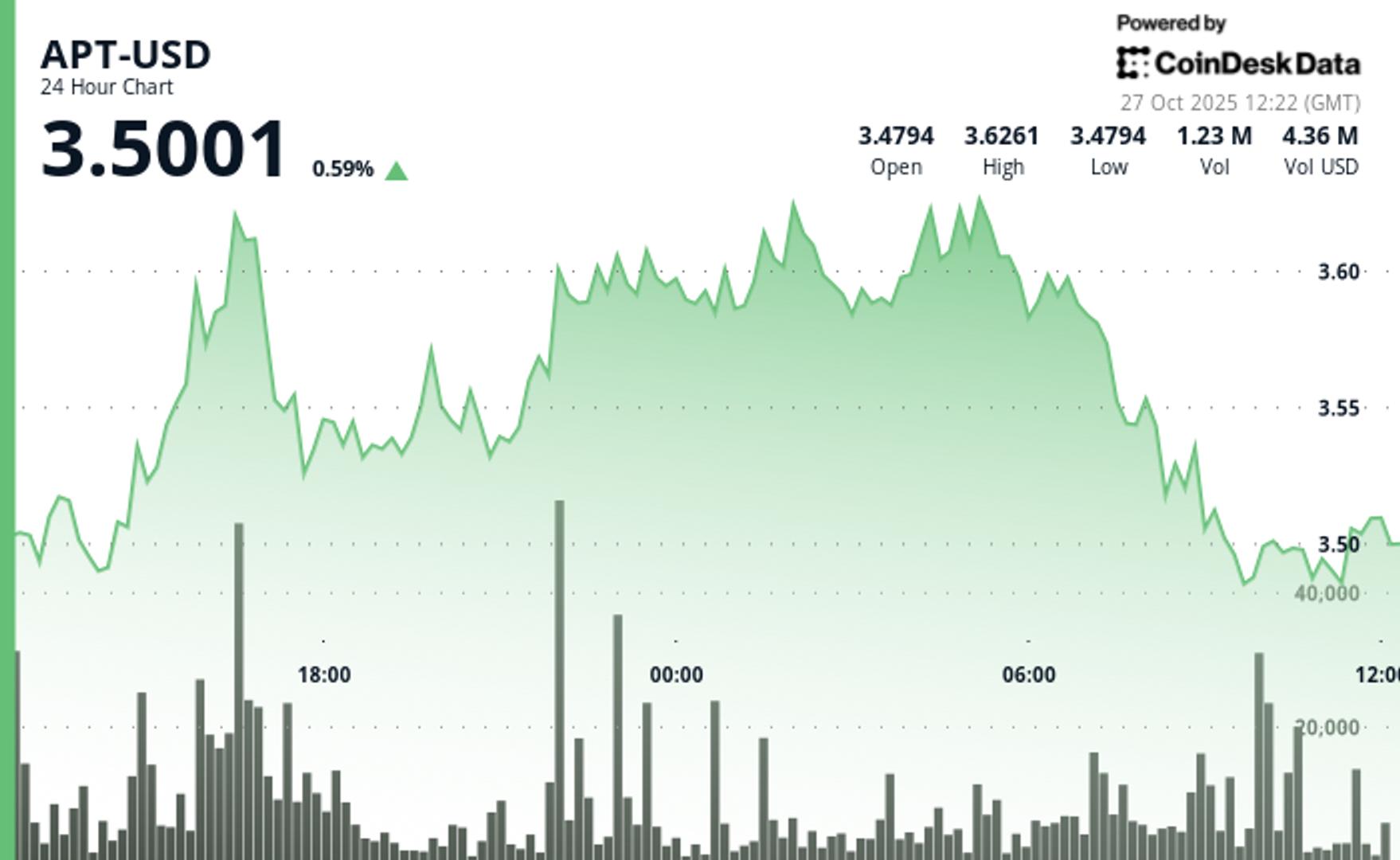

remained unchanged in the last 24 hours, trading around $3.50.

A possible break above the $3.63 resistance points to the $3.75 level for a potential 7% upside, according to CoinDesk Research’s technical analysis model.

The token underperformed the broader crypto market and its trading volume remained moderate throughout the period. The broadest gauge of the cryptocurrency market, the Coindesk 20 Index, was up 1.1% at press time.

The model showed that APT price created a range of $0.16 representing 4.6% of current levels as it moved up from session lows near $3.45.

Volume spiked to 2.48 million shares on Oct. 26, a 68% increase above the 24-hour average of 1.47 million, before quickly fading as the price hit resistance at $3.63, according to the model.

Multiple failed breakout attempts in the $3.60 to $3.63 area established this level as a critical technical barrier, according to the model.

The combination of modest gains coupled with tepid volume generally indicates retail-driven activity rather than significant institutional flows, suggesting traders remain in wait-and-see mode at current levels.

Technical analysis:

- Primary support remains between $3.48 and $3.485 after successful defense during the recent pullback, while resistance remains firm between $3.60 and $3.63 following multiple rejection attempts.

- 24-hour volume averaged 7.9% above the 7-day moving average, but fell short of the 5% institutional commitment threshold, pointing to retail-driven flows rather than significant capital deployment.

- The V bottom formation on a 60-minute period suggests a short-term bullish structure, with higher lows of $3.45 to $3.48 confirming the short-term uptrend momentum.

- A break above the $3.63 resistance points to the $3.75 level for a potential 7% upside, while the violation of the $3.48 support exposes the $3.40-$3.45 zone.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.