Ark Invest increased its target price of Bitcoin (BTC) from decade to $ 2.4 million each after reviewing its assumptions about the active supply, which excludes lost or long currencies. The largest cryptocurrency per market value was recently quoted around $ 94,000.

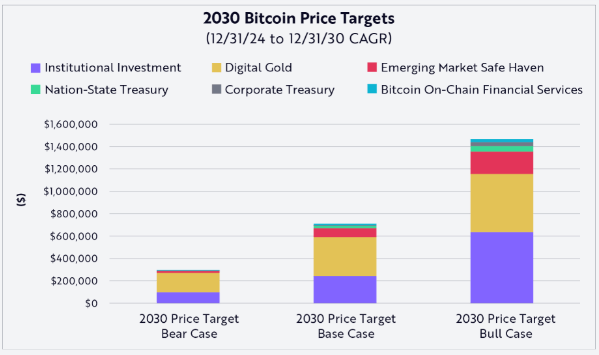

The Toro Protection figure, 60% more than its January 2024 estimate, reflects an annual growth rate of 72% (CAGR) from last December to the end of 2030. The base case estimates a BTC price of $ 1.2 million, a 53% CAGR, while the Bear case projects $ 500,000, equating a CAGR of 32%.

David Puell, an investment company analyst led by Cathie Wood, used a model based on the total directable market and the projected penetration of the market in several sectors. These include institutional investment, Bitcoin’s role as “digital gold”, its use as a refuge in emerging markets, the adoption of treasury-state-nation holdings and chain financial services built on the Bitcoin network.

In November last year, Puell went to $ 104,000- $ 124,000 by the end of the year. Bitcoin ended in December at $ 93,440 along the way to reach a record of $ 109,000 in January before falling to the minimum around $ 74,500 earlier this month.

The rally since then is driven in part by the decrease in exchange balances, indicating that more BTC is withdrawn in private wallets, a sign of long -term maintenance behavior. According to Glassnode data, BTC of exchange has fallen from approximately 3 million in November 2024 to 2.6 million, which reinforces the growing bullish feeling around cryptocurrency.