Good morning, Asia. This is what news is doing in the markets:

Welcome to Asia Morning Briefing, a daily summary of the main stories during the US hours and an overview of the movements and market analysis. To obtain a detailed description of the US markets, see Cryptokook from Coindesk America.

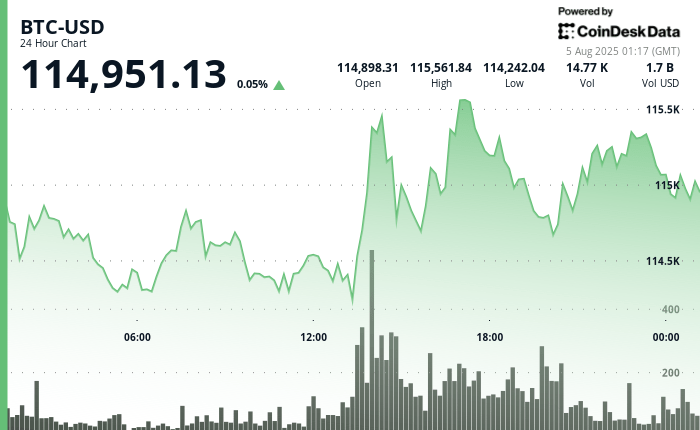

As East Asia begins its negotiating day, Bitcoin (BTC) is changing from a little more than $ 115K, organizing a modest rebound of the sale of the sale of more than $ 1 billion in long leveraged leverage and BTC briefly proves $ 113k.

The rebound is produced in the midst of stabilization signs in institutional flows, with a bit to bit that report $ 18.74 million in net tickets, a possible investment after one of the largest days of ETF departure output recorded last Friday.

The last correction, which marked the third sale of BTC on consecutive Friday, was promoted by an aggressive macro cocktail: weak job data in the US. UU. And a new wave of Washington rates, which caused a broader mood in actions and crypto. The Altcoins brought the worst part of the movement, with a sun falling almost 20% in the week and ETH lost about 10%.

However, despite the fall, QCP Capital remains cautiously optimistic.

“The broader structural configuration remains intact,” the firm wrote in a Monday note, citing the highest monthly closure of BTC in July.

QCP considers the sale of the sale as a leverage discharge instead of a reversal of trends, pointing to the historical shakes after the rally that clear the way for a renewed accumulation.

That said, market coverage behavior suggests that investors do not rule out a deeper inconvenience. In Polymket, operators currently assign a 49% probability that BTC is submerged below $ 100,000 before the end of 2025, more than 2 percentage points since the previous day.

The price reflects a market that is still on the edge, with the risk of low tail despite the long -term support foundations, such as regulatory clarity, the growing adoption of stablecoin and tokenization initiatives.

The next catalyst could arrive during Asia’s negotiation day when the United States emitters report flows, which generally occur at half -day Hong Kong.

If ETF inputs continue and implicit volatility begins to compress, it can provide the necessary confirmation for the market to adopt the purchase and shake narrative the macro nerves that have kept it attached in neutral.

Market Movers:

BTC: Bitcoin operates again above $ 115,000, indicating early market stabilization signs.

ETH: Ether remains stable of around $ 3,700, with Polymeket merchants who show confidence that will break over $ 4,000 at some point in August.

Gold: Gold extended his rally for a third session on Monday, increasing to a maximum of two weeks as the soft economic data of the United States increased the expectations of a rate cut of the September Fed, and CME merchants now have a price of 86% of possibilities that this happens.

Nikkei 225: Asia-Pacific markets opened more after the president of the United States, Donald Trump, announced plans to abruptly increase tariffs in Indian exports. Nikkei 225 of Japan increased by 0.54% outdoors.

S&P 500: The shares were recovered on Monday, with the S&P 500 increasing 1.47% to 6,329.94, breaking a four -day losing streak and marking its best session since May.

In another part of Crypto:

- Barry Silbert de DCG returns to the gray scale as president in the middle of IPO Push (Coindesk)

- Former Chancellor Osborne warns that the United Kingdom is “completely left behind” in crypto (Decrypt)

- Panther leads the increase of $ 20 million for the OpenMind decentralized operating system for robots (the block)