Good morning, Asia. This is what news is doing in the markets:

Welcome to Asia Morning Briefing, a daily summary of the main stories during the US hours and an overview of the movements and market analysis. To obtain a detailed description of the US markets, see Cryptokook from Coindesk America.

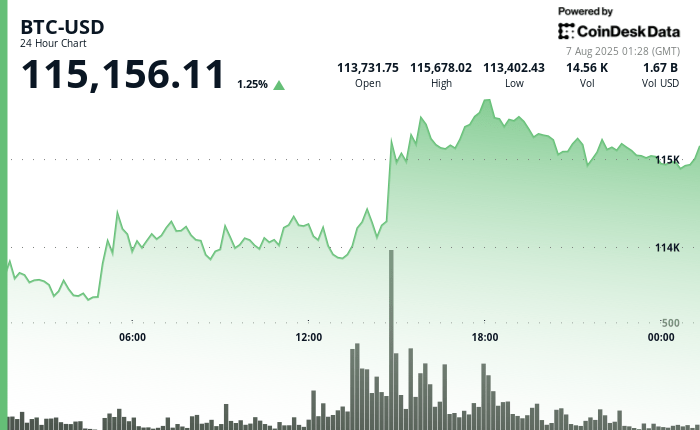

Bitcoin (BTC) is stomping around $ 115K on Thursday morning in Asia, 1% more in the last 24 hours, since the correction after all time continues to develop a low volume and a weak conviction.

According to Glassnode, BTC has entered what he calls an “air gap”, a low liquidity zone between $ 110,000 and $ 116,000, after decomposing an important supply group where the short -term holders had previously found support.

These areas generally see little commercial activity and can serve as the basis for accumulation or become a trapPPLA for a deeper disadvantage if the demand does not return.

“The market is effectively restarting its balance,” wrote Glassnode analysts, which describe the range between $ 110K (the previous ATH) and $ 116K (recent base of the buyer costs) as the new battlefield.

They pointed out that, although the opportunistic purchase has emerged, with 120,000 BTC acquired in the fall, prices have not yet recovered resistance levels convincingly, particularly the threshold of ~ $ 116.9k that marks the recent points of entry to the headline in the short term.

The return of the short -term holder has decreased from 100% to 70%, which Glassnode frameworks are typical for an average phase of the upward market. But without fresh entries, this could quickly erode the feeling. ETF flows have become negative, with a BTC -1.5K output flow earlier this week, the largest since April. At the same time, financing rates in the derivative market have cooled, reflecting reduced leverage and a more cautious posture among speculators.

The Mercado Enfux manufacturer offered a similar shot: “Cryptographic markets remain in a fragile retention pattern. Despite a certain relief in the Altcoin space, specialties such as BTC and ETH are still struggling to inspire confidence,” he wrote in a client’s note. “The broader trend? Heavy legs with more or less volume of light.”

ETH has increased 2% in the last 24 hours, quoting just below $ 3,600. The Coindesk 20 index, which tracks a wide basket of cryptographic assets, won 1.69% to 3,815.22.

“Until BTC and Eth recover the force with volume,” Enflux added, “the way of lower resistance could remain from side to bottom.”

The next market movement probably depends on whether buyers are willing to intervene and build a base within this low volume area, or if another discharge is needed to $ 110K to restore the trend. For now, merchants are still cautious and bulls remain not tested.

Market Movers:

BTC: A possible supply shock of Bitcoin, driven by the drying of OTC desktop reserves and accumulation of constant corporations, could “decort” the action of the price of BTc after a fall below $ 110K, market observers say.

ETH: Ethereum may have formed a local top since the sales pressure reaches $ 419 million, its second highest registered, while ETH re-tests an important resistance zone about $ 4,000 that preceded a 66% drop at the end of 2024, increasing the risk of a decrease of 25-35% in September; Meanwhile, Polymeket tractors remain divided, with 48% backup of a rally at $ 5,000 despite the bearish signals.

Gold: The Gold rally stagnated on Wednesday when the merchants obtained profits and weighs the probabilities of reduction of the Fed rate, the US commercial tensions. UU. And an imminent shock of Fed leadership, leaving flat prices after a three -day gain driven by economic weakness; Spot Gold was last negotiated at $ 3,372.11, 0.24% less than the day.

Nikkei 225: Asia-Pacific markets opened on a mixed Thursday, with Nikkei 225 Flat from Japan, while investors shrunk the new threats of US semiconductor rates.

S&P 500: The future of US shares. UU. They were flat on Wednesday night when merchants digested the new Trump semiconductor rates, with the S&P 500 still 1.7% during the week.

In another part of Crypto:

- The leaders of the Cheer Liquid Staking’s Sec Green Light industry, opening doors for institutional adoption (the block)

- Roman storm guilty of money without a license that transmits conspiracy in partial verdict (Coindesk)

- Trump Media Test ‘Search for truth’ using perplexity AI (decipher)