Good morning, Asia. This is what news is doing in the markets:

Welcome to Asia Morning Briefing, a daily summary of the main stories during the US hours and an overview of the movements and market analysis. To obtain a detailed description of the US markets, see Cryptokook from Coindesk America.

Bitcoin (BTC) quoted at $ 119,430 in the early hours of Asia on Monday, an increase of 1.24%, as the bullish impulse continued after a series of institutional milestones and an innovative commercial agreement between the United States and the European Union. The Coendesk 20 (CD20) index increased 2.37% to 4.099.18, extending its recent recovery.

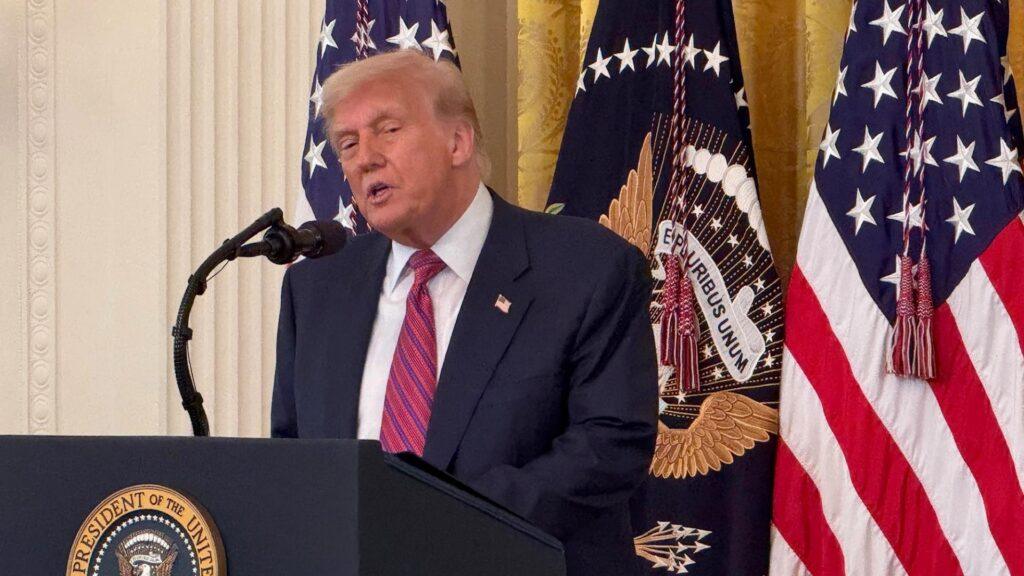

During the weekend, President Donald Trump and the president of the European Commission, Ursula von der Leyen, announced a Marco Commercial Agreement in Turnberry, Scotland, which establishes an American import tariff of 15% on EU assets, avoiding the previously threatened 30% rate. The agreement includes $ 600 billion in EU investment in energy and defense of the United States in the next three years and aims to reduce the dependence of Europe in Russian fuel. Tariffs on steel and aluminum remain at 50% at the moment.

At the same time, the market capitalization of Bitcoin, a measure of the total BTC value based on the last time each currency moved, crossed the threshold of $ 1 billion for the first time, according to Glassnode.

All this comes as BTC continues to consolidate over $ 118,000 after reaching a record of $ 122,700 last week. The rally triggered an important sale of long -term headlines, while based on new buyers and fresh capital. The BTC domain, which measures the Bitcoin market share in relation to the total cryptography market, has been reduced to 60.98%, which suggests a modest rotation in Altcoins.

On Friday, Galaxy Digital announced that he had executed a BTC transaction of $ 9 billion in the name of an investor of the Satoshi era, one of the largest Bitcoin transfers in history. The sale included 80,000 BTC and, according to the reports, was part of a patrimonial planning strategy.

The lack of price movement despite the size of the agreement is probably a testimony of how much BTC is Illicid, thanks to the long -term cascad. A market on the edge of a supply shock rally can take an additional sale of $ 9 billion.

Meanwhile, Polymarket’s doors now give BTC a 24% probability to reach $ 125,000 before the end of July, compared to 18% earlier. The greatest probabilities arise as merchants weigh the impact of macro tail winds and the growing condemnation in the chain.

Market movements

BTC: Bitcoin is quoted above $ 119K as the United States and the European Union sign a commercial agreement, while Caramelo data shows that merchants have submerged in the short positions of the majority.

ETH: Ether is quoted at $ 3,867.76, 3% more, amid strong foundations in the chain: 28% ETH is bet, exchange balances are at a minimum of eight years and the new tickets of buyers are increasing.

Gold: Gold has fallen for a fourth consecutive day, quoting around $ 3,335 at the beginning of Asia despite a gain of 28% in the year to date, since progress in the US trade agreements. UU. And USA and China reduces safe demand before the fomc meeting this week.

Nikkei 225: The Asia-Pacific markets negotiated on Monday while investors waited for details of the US commercial conversations.

In another part of crypto

- Michael Saylor is bringing a monetary -style vehicle backed by Bitcoin to Wall Street: Nydig (Coendesk)

- The pharmaceutical company will buy up to $ 700 million in BNB after Coin reaches all time (Decrypt)

- This fake bitcoin automatic cashier scheme has wasted 4,000 hours of scam time (DECYPT)