Good morning, Asia. This is what news is doing in the markets:

Welcome to Asia Morning Briefing, a daily summary of the main stories during the US hours and an overview of the movements and market analysis. To obtain a detailed description of the US markets, see Cryptokook from Coindesk America.

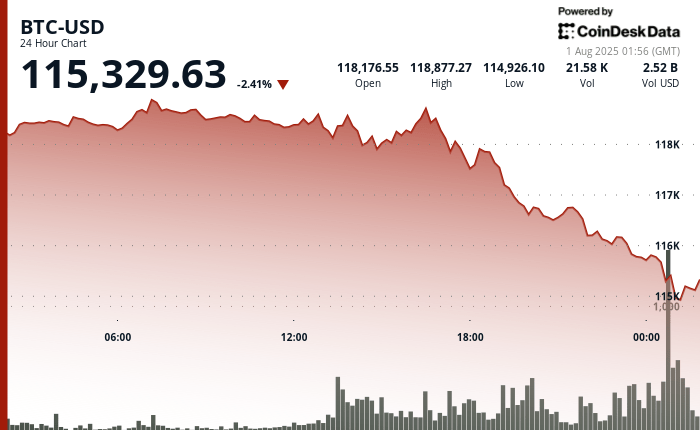

Bitcoin (BTC) is ready to finish the negotiation week in Asia dropped 2.3% in the day, changing their hands above $ 115,300.

A new round of global White House tariffs is dragging the markets in Asia, with the Nikkei 225 opening in the red along with the Seoul Kopsi. Bitcoin is also not immune to this, since historically digital assets also follow capital markets when the White House announces tariffs, although that has also begun to weaken.

Caramel data shows that around $ 260 million in long positions have been liquidated in the last 4 hours.

BTC is struggling with tariff pressure and the taking of continuous gains after a historical career beyond the maximum of all time.

According to a new Cryptoquant report, Bitcoin has just experienced its third major wave of gaining of the 2023-2025 bull cycle, with $ 6–8 billion in earnings registered at the end of July.

Like the previous phases, this wave was defined by large peaks in the relationship of worn production (SOPR), particularly among the short -term holders, and a sale of 80,000 BTC significant by an OG whale on July 25.

The new whale cohorts, which accumulated BTC in the last 155 days, were the dominant vendors, according to the data provider.

Exchange tickets increased to 70,000 BTC in a single day after the OG whale was sold, a level that usually indicates a strong intention to get out of positions at maximum prices.

The sale was not limited to BTC: Ethereum -based whales that WBTC, USDT and USDC has also obtained up to $ 40 million in daily earnings, which further supports the narrative of broad base capital rotation.

Historically, these earnings events have been followed by a consolidation period two to four months before the next highest stage, Cryptoquant wrote. That employer can play again, with the appetite of US investors decreasing.

The Coinbase premium, an indicator that tracks the price differences between coinbase and other global exchanges, recently turned negative, suggesting that US buyers are no longer paying a premium.

In addition to the cautious tone is the return of macro risk. Trump’s tariff climb, including new measures that are specifically directed to Canada, has caused broader risk assets. Both the actions, the ties and the cryptography saw decreases in the midst of fears of inflation and interruption of the supply chain.

Without a macro catalyst or clear structural inputs, the risk takes remains selective and conviction light, the market manufacturer added Enfix in a note for Coindesk.

“Until BTC or ETH can publish a clean recovery of recent local maximums, the price action can remain agitated and thematic rotation instead of a trend,” said the market manufacturer.

Market movements:

BTC: Bitcoin (BTC) is quoted at $ 115,500, 2.3% less in the day, since the renewed white houses weigh on Asian markets; Despite the fall, BTC remains in reach.

ETH: Ethher (ETH) was around $ 3,800 on Thursday after increasing more than 50% in July, its best month since 2022, as bullish price objectives circulated on social networks, including a popular analyst that projects a break at $ 15K– $ 16K this cycle, backed for $ 5.3 billion in ETF clouds of US ETF. UU. And a strong institutional demand.

Gold: Gold increased to $ 3,296 on Thursday earlier before falling to $ 3,287,39, 0.38%lower, since the purchase of fall compensated a firm US dollar after the Fed kept the parked rates and Powell retreated a September cut in strong job data and inflation of growing central PCE.

Nikkei 225: Asia-Pacific markets opened the lowest Friday, with Japan Nikkei 225 less 0.65% and the broader negotiation index index

S&P 500: Futures S&P 500 fell on Thursday night when merchants weighed great technological profits and looked towards the Julio job report.

In another part of Crypto:

- Tyler Winklevos has ‘serious concerns’ about Trump’s choice to lead the CFTC, Brian Quintenz (the block)

- Blockchain’s stable centered on the edge collected $ 28 million to Power Stablecoin Payments (Coindesk)

- HKMA’s strict Stablecoin regime to shape Crypto Future (SCMP) of Hong Kong (SCMP)