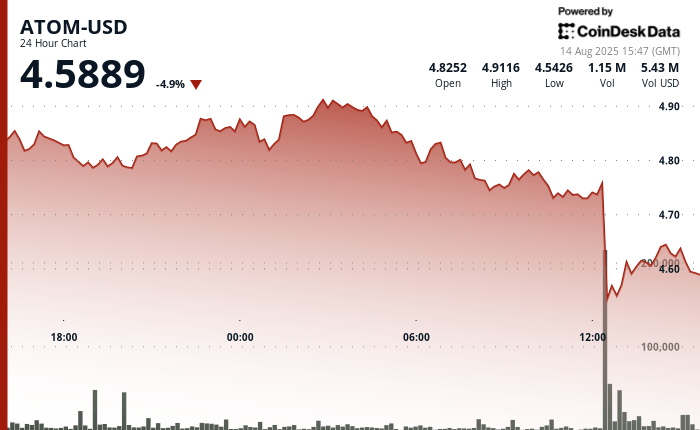

Atom-Use saw a strong volatility between August 13, 15:00 and August 14, 14:00, quoting between $ 4.49 and $ 4.91 with an increase in volume to 5.62m units, more than 322% above average. After keeping $ 4.82– $ 4.85 and briefly reach $ 4.91, the asset faced a sale of an aggressive sale from 06:00 on August 14, touching $ 4.53 at 12:00 in a heavy volume, pointing out a potential capitulation.

Buyers intervened rapidly, establishing a new support about $ 4.60 and restoring confidence in the Cosmos ecosystem. This price level became a key threshold as the sales pressure decreased and trade stabilized.

During the recovery window of 60 minutes from 13:20 to 14:19 on August 14, ATOM increased from $ 4.60 to $ 4.61, reaching its maximum point at $ 4.64 before consolidating in an adjustment of $ 4.59– $ 4.62. This confirmed $ 4.60 as a support base, suggesting a possible launch point for future profits.

While resilience is evident, resistance to $ 4.91 remains without trying. Maintaining $ 4.60 will be crucial to maintain a bullish impulse, with any breakdown risking a renewed downward pressure.

Technical indicators point to consolidation

- Price range of $ 0.42 that represents a volatility of 9% between $ 4.91 maximum and $ 4.49 minimum.

- Increase volume to 5.62 million units, higher than the average of 24 hours of 1.33 million in 322%.

- Resistance level established at $ 4.91 during the early morning of August 14.

- The support base training around $ 4.60 after the recovery of $ 4.53 minimum.

- Consolidation pattern between $ 4.59- $ 4.62 rank that indicates a potential stabilization.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.