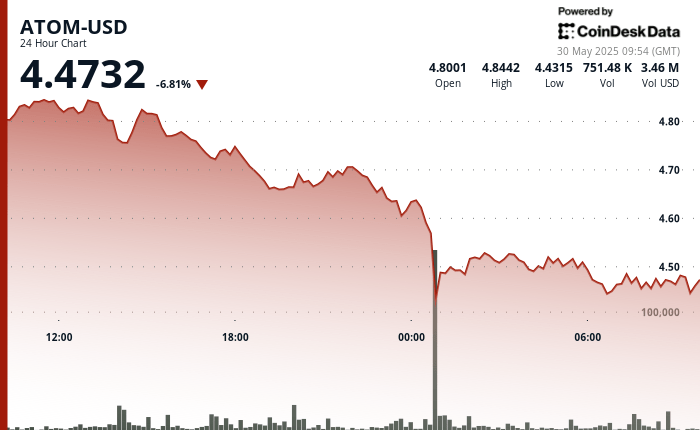

Atom saw a significant volatility with prices ranging from a maximum of $ 4,848 to a minimum of $ 4,413. In the last two hours, fluctuations with picos of $ 4,492 and channels were observed at $ 4,454.

Geopolitical tensions and evolutionary commercial policies influenced the performance of atom, impacting the broader financial markets and cryptocurrency assessments alike.

The increase in interest in ATOM and other cryptocurrencies such as Avalanche and Polkadot reflects the possible June profits, underlined by volume and strategic integrations of Blockchain.

In recent observations, Atom experienced substantial volatility with its oscillating price between ups and downs in a dynamic market.

A remarkable price range of $ 0.435, which represents a change of 9%, indicates turbulent trade conditions. Significant market activity, especially observed on May 30 with an increase in volume to 3.05 million, contrasts with a broader tendency to decrease in volume, which suggests a high but selective market interest.

This increase coincides with geopolitical tensions, which not only influence commercial policies, but also have dominance over inflation and monetary policy decisions.

Such macro level factors have a complex network of influences that investors must navigate. In addition, microeconomic elements, such as the flourishing interest in blockchain -based cryptocurrencies, suggest potential rupture actions for ATOM, along with Avax and Dot.

TECHNICAL ANALYSIS

- Observed price range: $ 4,848 (high) at $ 4,413 (bass). – Support level identified around $ 4.67 with resistance to $ 4.84.

- Recent short -term support about $ 4.45 and resistance to $ 4.48.

- Volume arises observed at 3.05 million on May 30, indicating the potential interest of the market.