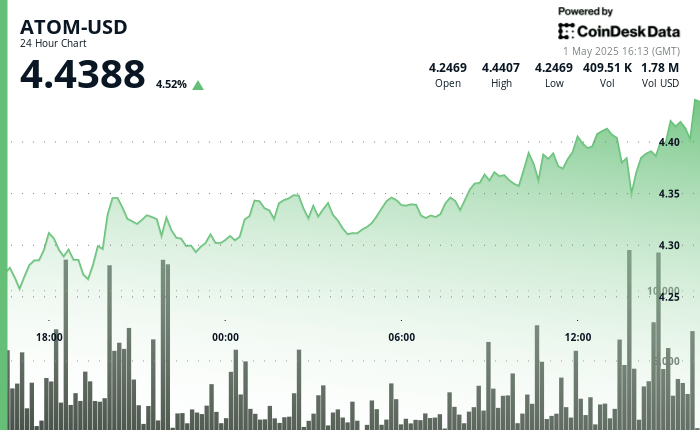

The cosmos ecosystem is gaining significant institutional attention in the midst of a widest market volatility, with an atom that shows remarkable resistance after recovering from a fall to $ 4.23 on April 30 to stabilize above $ 4.38.

The price of the atom increased more than 4% in the last 24 hours, while the broader market meter index Coindesk 20 rose almost the same amount.

This recovery is produced as Canarian capital files for the first SEI ETF Spot built on SDK cosmos, with rethinking capabilities that could establish a precedent for similar products throughout the ecosystem.

Meanwhile, the block chain of the figure of the figure, also built with SDK cosmos, has become the private credit leader tokenized with $ 9.9 billion in active loans, validating the vision of the Blackrock Larry Fink CEO that “each asset can be token.”

Technical analysis: Atom recovery pattern

- ATOM-USD has demonstrated a remarkable resistance during the period analyzed, recovering from a significant fall to $ 4.23 on April 30 to stabilize above $ 4.38 for May 1.

- The general range of $ 0.31 (6.9%) reflects moderate volatility, with a strong support established at $ 4.30- $ 4.32, according to the technical analysis data of Cindensk Research.

- The recent price action shows a developing bullish trend with higher minimums that have been formed since April 30, accompanied by the increase in volume during recovery phases.

- The fibonacci setback from the maximum of April 29 suggests that the current price has recovered the level of 61.8%, with resistance to $ 4.41- $ 4.42 that represents the next significant obstacle before the continuous potential towards the previous maximums.

- ATOM-USD has shown significant volatility in the last 100 minutes, experiencing a strong decrease of $ 4.41 to a minimum of $ 4.35 before organizing a recovery at $ 4.38.

- The price action formed a V-shaped pattern, with a strong emerging purchase in the support zone of $ 4.35- $ 4.36. This was accompanied by remarkably higher negotiation volumes during the sale of the sale (reach of the 103,987 units at 14:00) and the subsequent recovery.

- The recent price movement has established a short-term bullish trend with higher minimums from 13:57, with the current price that is consolidated about $ 4.38- $ 4.39, which suggests stabilization after the above volatility and the potential to continue the ascending impulse if the resistance level of $ 4.39 can be breached.

Discharge of responsibility: parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee precision and adherence to Our standards. For more information, see Coindesk’s complete policy.

References:

- Bitcoinista, “Bitcoin approaches Golden Cross since the MVRV ratio generates impulse: is a rupture arriving?“Posted on April 7, 2025.

- Bitcoinista, “The best presales to buy as institutional flows return to Bitcoin, says Blackrock“Posted on April 7, 2025.

- BlockWorks, “How private credit token leads the career in tokenization“Posted on April 30, 2025.

- Cryptonews, “Canarian capital archives for the first sei ETF spot in the US“Posted on April 24, 2025.