Avalanche

He struggled to maintain a short -term impulse, with trade patterns that show a formation of descending channels despite the attempts to stabilize the key support levels, according to the technical analysis model of Coindesk Research.

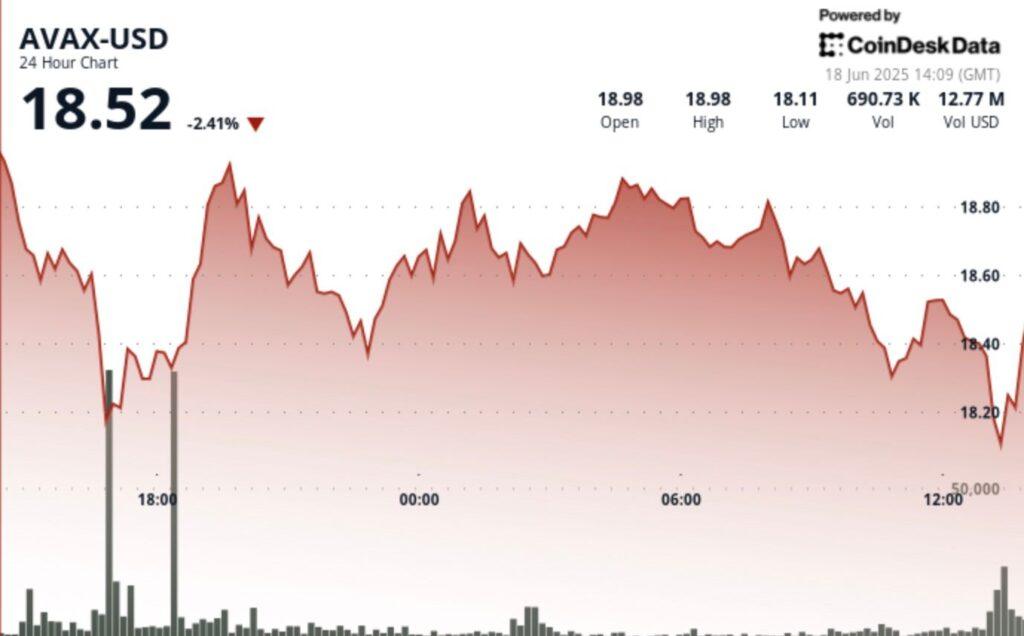

The Token has fallen 1.4% in the last 24 hours to $ 18.43, while Coendesk 20, an index of the 20 main cryptocurrencies for market capitalization, excluding stable, memecors and exchange currencies, lost only 0.5%.

The recent high volume sales pressure suggests a continuous bearish feeling in the short term, although a strong purchase arose during recent falls.

Technical analysis

• AVAX experienced significant price volatility in the last 24 hours, establishing a range of 0.84 (4.5%) between the maximum of $ 18.93 and the minimum of $ 18.09.

• The asset found strong support in the area of $ 18.15- $ 18.25, while facing resistance about $ 18.85- $ 18.90.

• The price action formed a descending channel, with a recent high volume sales pressure, which suggests a continuous bearish feeling despite the attempts to stabilize around the level of $ 18.40.

• AVAX experienced a V -shaped recovery, falling from $ 18.35 to a minimum of $ 18.09 with an exceptionally high volume (52,056 units) before recovering at $ 18.40.

• The recovery gained significant impulse when the price broke through the resistance at $ 18.27 in volume greater than 67,000 units, establishing a new support zone around $ 18.33- $ 18.35.

• The upward trend culminated in three consecutive minutes of zero volume, which suggests a possible consolidation before the next price movement.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.