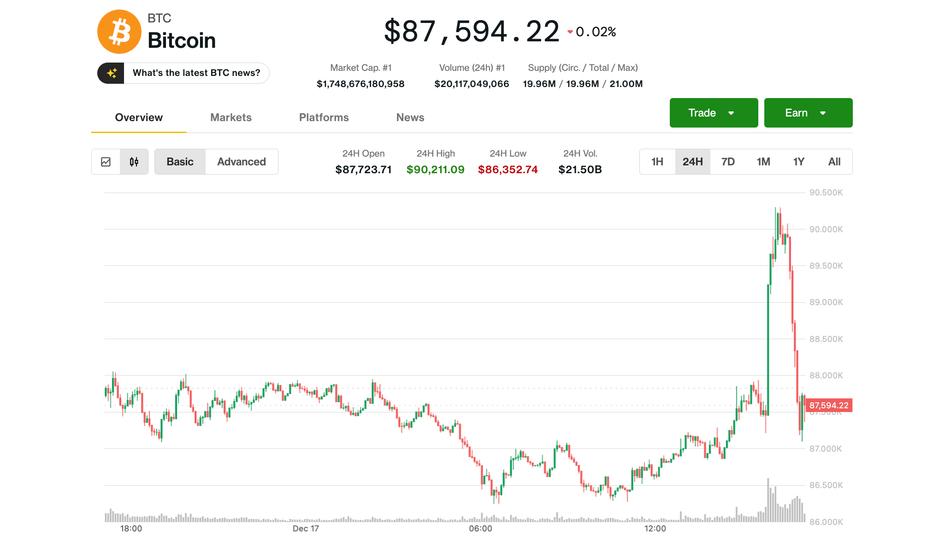

Crypto markets saw big action in US morning trading, with bitcoin In the space of a few minutes, it rose from around $87,000 to over $90,000 and then back to the $87,000 area.

The largest cryptocurrency was recently trading at $87,300, down 0.5% in the last 24 hours after rising more than 3% minutes earlier.

The rapid decline came alongside heavy losses for AI-related stocks, with Nvidia, Broadcom and Oracle suffering declines of 3% to 6%. The technology-focused Nasdaq fell more than 1%.

Helping to deflate AI sentiment, Blue Owl Capital reportedly pulled out of funding a $10 billion deal for an Oracle data center in Michigan.

The sudden price swings sparked more than $190 million in liquidations in crypto derivatives markets in the past four hours, CoinGlass data shows. The volatile stock reached $72 million in long positions, looking to benefit from rising prices, and $121 million in short positions, betting on a decline.

Reduced liquidity at margin is the main culprit behind bitcoin’s aimless trading, making it vulnerable to any external pressure, Hunter Rogers, co-founder of bitcoin yield protocol TeraHash, said in a note.

“I think we’re seeing a depleted market now,” he said. “In that environment, even mild selling activity pushes the market lower.”

He added that BTC needs to hold the $80,000-$85,000 area as support, which could decide whether new lows or a more sustainable bounce will follow.