The cryptographic market goes back slightly from early Friday’s nerves about the growing conflict between Israel and Iran.

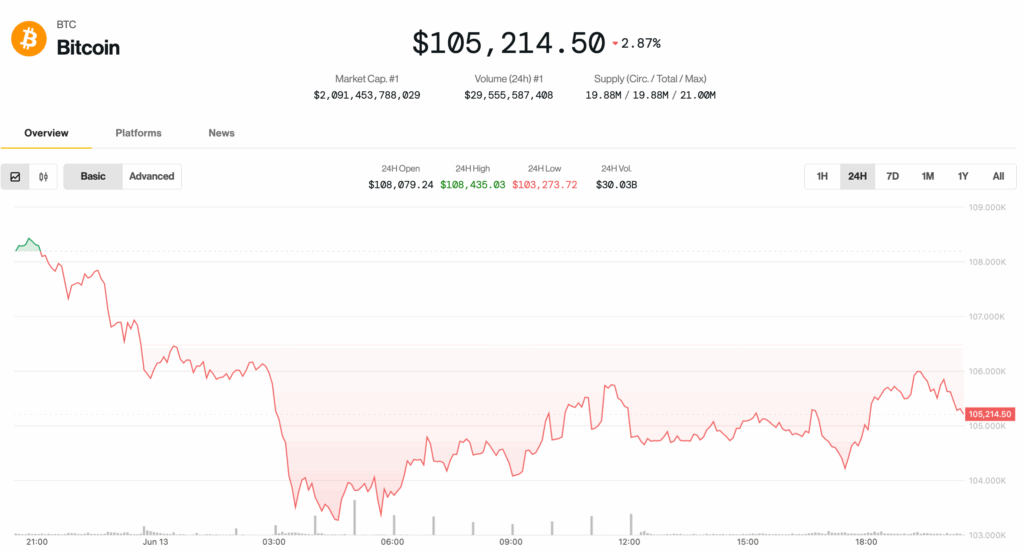

After falling to the $ 102,600 mark, Bitcoin

Rebounded to about $ 106,000 before fading in the afternoon hours of the USA. With reports on a new wave of air attacks aimed at Iran. The upper cryptocurrency decreased 1.6% in the last 24 hours, changing from hands to $ 105,200 and even less than 6% less than its high historical price.

Meanwhile, Coindesk 20, an index of the 20 main cryptocurrencies for market capitalization, excluding Memecoins, Stablecoins and Exchange Coins, has lost 4.4% in the same period of time. Tokens like Ether

Avalanche and Toncoin were the most affected, falling between 6% and 8%.

However, cryptographic stocks are not too hot. Most of the shares are in red, especially Bitcoin Mara Holdings (Mara) and riot platforms (Riot), 5% and 4% respectively. A remarkable exception is Stablecoin Emier Circle (CIRCL), which still benefits from the unexpected gain of its recent IPO; The action has increased 13% today, with news from the Retail Giants Amazon and Walmart, according to reports, exploring Stablecoins by increasing the impulse.

Traditional markets do not seem overwhelmingly concerned about war. Although gold has increased 1.3%, potentially preparing for new historical maximums, the S&P 500 and Nasdaq have only dropped 0.4% each.

What follows Bitcoin?

“Nice rebound so far and lack of lower tracking,” said Skew from Crypto Trader, well, he said on a Friday X post. Market participants will probably remain cautious over the weekend with BTC closely correlated with traditional markets in the midst of higher geopolitical risks, Skew added.

Within the longest period, some analysts see the risks of a deeper setback.

The 10x Research founder, Markus Thielen, said that the fall of BTC below the $ 106,000 translates into a failed break, and merchants should wait for more favorable configurations before hurrying to buy the fall.

He highlighted the $ 100,000- $ 101,000 area as a key support, warning that a break could then mark a return to the broader consolidation phase similar to last summer.

John Glover, Investment Director of the lender Bitcoin Ledn, argued that Bitcoin entered a corrective phase from its maximum record that could see that the largest digital asset falls to $ 88,000- $ 93,000.

He said that the $ 90,000 level could offer a favorable entry for opportunistic investors before BTC resumes their trend within reach.

“Once this pattern has developed, the next higher movement of $ 130,000 is expected to begin,” he said.