By Omkar Godbolole (all time and unless otherwise indicated)

The encryption market shows signs of stabilization, with Bitcoin recovering to $ 102,000 and positive futures signs linked to NASDAQ. Lead the recovery between the main cryptocurrencies is XRP, 11% more, followed by sun with an increase of 7%. The AI coins, beaten on Monday, are publishing profits of up to 4%.

It is likely that the feeling of risks will be backed by the skepticism that surrounds the claims of the Chinese technological startup Depseek, which states that it only spent $ 6 million to develop its competitor for Chatgpt. Critics speculate that the figure omits the costs associated with previous research and experimentation on architectures, algorithms and data. In addition, a concept rooted in Jevons’s paradox suggests that progress in efficiency often leads to greater use instead of a reduction in consumption, which leads to net positive growth in the industry.

That is good news for Bitcoin and the broader cryptographic industry because they align with the narration of American exceptionalism, particularly given the crypto-friendly position of President Trump and plans to establish a reserve of strategic digital assets.

Speaking of the strategic reserve, Arizona legislators have advanced a bill that would allow government entities or public funds to invest up to 10% of their capital in Bitcoin and other digital assets.

The broader perspective remains optimistic, with data in the chain pointing to the capitulation of weak hands and a continuous accumulation of large investors.

“According to cryptocant data, the proportion of investors with a balance of at least 1,000 BTC that bought coins in the last 155 days increased from 43% to 60%, which reflects the appearance of large players in the middle of an optimistic feeling,” Alex Kuptsikevich, chief Market Analyst at the FXPRO, said.

QCP Capital expects this week to test the BTC correlation with shares, particularly as a favorable regulatory environment offers potential support. Stay alert!

What to see

- Crypto:

- January 28, 1:00 PM: Update of the Hedera Network (HBAR) (V0.57.5).

- January 29: The update of the Cardano Lead Bifurcation Network.

- January 29: Start Ice Open Network (Ion) Mainnet.

- February 2, 8:00 pm: Core Blockchain Athena Hard Fork Network Update (V1.0.14)

- February 4: Microstrategy (Mstr) Q4, FY 2024 profits.

- February 4: Pepecoin (Pepe) in half. In block 400,000, the reward will fall to 31,250 PEPE.

- February 5, 3:00 pm: The update of the Holocene Boba Network fork for its L2 Mainnet L2 based on Ethereum.

- February 6, 8:00 am: Update of the SHENTU chain network (V2.14.0).

- February 12: Hut 8 Corp. (HUT) P4 2024 profits.

- February 15: Qtum (Qtum) Hard fork Network Current in block 4,590,000.

- February 18 (after market closure): Semler Scientific (SMLR) Q4 2024 profits.

- February 20: Global Coinbase (Coin) Q4 2024 profits.

- Macro

Token events

- Government votes and calls

- Morpho Dao is voting whether to reduce Morpho’s rewards by 30% in all assets and networks and establish all assets that are not those with ETH or USD denominations to have the same reward rate as the assets called BTC.

- Sky Dao is voting whether to reduce the WBTC settlement threshold from 55% to 50% in Sparklend Ethereum.

- Anenn Dao is voting whether to finance and support Bearn, a new subdao with the aim of building and launching products in Berachain.

- You unlock

- January 28: Tribal Token (Tribib) will unlock 14% of its circulating supply for a value of $ 60 million.

- January 31: Optimism (op) to unlock 2.32% of the circulating offer for a value of $ 52.9 million.

- January 31: Jupiter (JUP) Unlock 41.5% of the circulating offer worth $ 626 million.

- February 1: SUI (SUI) to unlock around 2.13% of its circulating supply for a value of $ 226 million.

- Tokens listings

- January 28: Pudgy Penguins (Pechegm) and Magic Eden (ME) will be included in Kraken.

- January 29: Cronos (Cro), movement (movement) and usual (usual) that will be listed in Kraken.

Conferences:

Token talk

By Shaurya Malwa

- Venice AI (VVV) centered on AI approached a market capitalization on Monday of $ 1 billion about its appeal to offer private inference access to the unsecured without application.

- The base -based token appeared in Coinbase, one of the rare assets that appear in the exchange day, which may have helped boost the movement.

- Users provide VVV tokens to get API access to the unconditional of the Deepseek, with ongoing rewards of Token emissions.

Derivative positioning

- The future of Bitcoin and Ether de CME saw a remarkable fall in the open interest on Monday, since the merchants detached themselves during an acute hole in Nvidia and other actions of Nasdaq.

- Perpetual financing rates for main currencies have stabilized in the range of 5%-10%annualized. The financing rates for BTC had turned briefly bassist below early Monday on Monday.

- BTC calls are more expensive than it is transmitted in all deadlines, while ETH front-end makes trade more expensive, which reflects the concerns of extended price falls in the coming days.

Market movements:

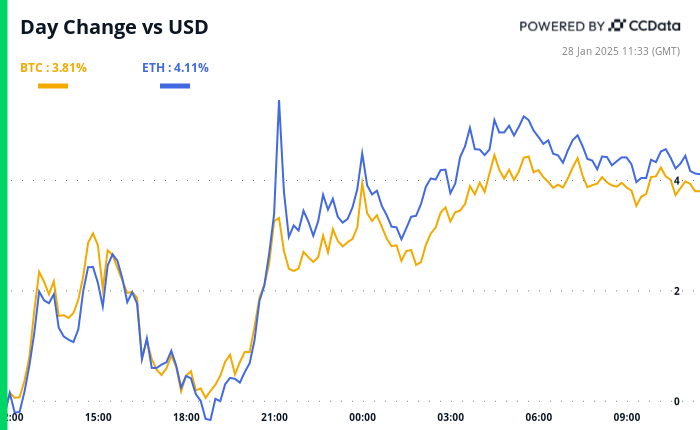

- BTC increases 1.32% from 4 pm et on Monday to $ 98,784.45 (24 hours: +4.07%)

- ETH increases 1.62% to $ 3,050.20 (24 hours: +4.52%)

- COINDESK 20 increases 3.2% to 3,536.28 (24 hours: +6.73%)

- The CESR compound rate increases 18 PB to 3.19%

- The BTC financing rate is at 0.0084% (9,2221% annualized) in Binance

- DXY has risen 0.57% to 107.95

- Gold has increased 0.34% to $ 2,743.59/oz

- La Plata rises 0.35% to $ 30.16/oz

- Nikkei 225 closed -1.39% at 39,016.87

- Hang Seng closed +0.14% at 20,225.11

- Ftse rose 0.58% to 8,553.75

- Euro Stoxx 50 has increased 0.47% to 5.212.71

- Djia closed Monday +0.65% to 44,713.58

- S&P 500 closed -1.46% at 6,012.28

- Nasdaq closed -3.07% to 19,341.83

- S&P/TSX Compiete Index Closed -0.7% at 25,289.15

- S&P 40 Latina America closed +0.34% at 2.330.61

- The 10 -year Treasury of the United States rises 3 bp with 4.57%

- E-mini s & p 500 futures rose 0.39% to 6070.50

- E-mini nasdaq-100 futures rose 0.67% to 21,400.25

- E-mini dow Jones The industrial average of the index of the futures does not change to 44,935.00

Bitcoin statistics:

- BTC domain: 59.16 (0.15%)

- Bitcoin Ethereum Relationship: 0.031 (-0.32%)

- Hashrat (seven -day mobile): 767 eh/s

- Hashprice (spot): $ 58.7

- Total rates: 6.13 BTC/ $ 616,619

- CME Futures Open Interest: 170,240 BTC

- BTC with a gold price: 37.6 oz

- BTC vs Gold Market Cap: 10.68%

Technical analysis

- Eth carved a candle with a long tail on Monday, pointing to the fatigue of the bear to the minimums intradic. That is often seen as a sign of a higher imminent trend change.

- Prices, however, remain trapped in a descending channel, suggesting a bassist perspective.

Cryptographic equities

- Microstrategy (Mstr): closed Monday at $ 347.92 (-1.63%), 0.36% to $ 346.66 in the previous market.

- Global Coinbase (Coin): Closed at $ 277.99 (-6.71%), 0.76% more at $ 280.11 in the previous market.

- Galaxy Digital Holdings (GLXY): closed to C $ 27.36 (-15.87%).

- Mara Holdings (Mara): closed at $ 18.28 (-8.53%), 0.63% more at $ 18.40 in the previous market.

- Riot Platforms (Riot): closed at $ 11.45 (-15.44%), 6.87% to $ 12.61 in the previous market.

- Core Scientific (Corz): closed at $ 11.28 (-29.41%), 2.22% higher than $ 11.53 in the previous market.

- CleanSTark (CLSK): closed at $ 10.31 (-10.62%), 1.21% more at $ 10.43 in the previous market.

- Coinshares Valkyrie Bitcoin Miners ETF (WGMI): closed at $ 20.78 (-20.75%), less than 3.99% at $ 21.61 in the previous market.

- Semler Scientific (SMLR): closed at $ 50.43 (-9.07%).

- Exodus movement (exod): closed to $ 74 (+20.82%), without changes in the previous market.

ETF flows

ETF flows

Spot BTC ETF:

- Daily net flow: -$ 457.6 million

- Cumulative net flows: $ 39.49 billion

- Total BTC Holdings ~ 1,157 million.

Spot Eth Ethfs

- Daily net flow: -$ 136.2 million

- Cumulative net flows: $ 2.67 billion

- Total eth holdings ~ 3.59 million.

Source: Farside Investors

Flows during the night

Figure of the day

- The volume of daily trade in decentralized exchanges based in Solana has fallen abruptly to less than $ 10 billion from the maximum of $ 35 billion recorded on January 18, when Trump’s token debuted and caused a memecoin frenzy.

- However, the volumes remain high in the average activity levels observed in November and December.

While you sleep

- Kucoin will pay a fine of almost $ 300 million after declaring himself guilty of the positions of the Department of Justice (Coindesk): Crypto Exchange Kucoin declared himself guilty of operating a business of transmission of money without a license, agreeing to pay $ 297 million in penalties and exit of the United States for two years.

- Tuttle Capital proposes Trump’s first ETFs of Trump, Melania, Cardano, others (Coindesk): Tuttle Capital Management presented 10 2x proposals of ETF crypt-applaments with the SEC, including those that track Trump and Melania Memecoins.

- Jim Cramer of Mad Money says ‘Bitcoin, not Microstrategy’. Critics often interpret their advice as an opposite indicator.

- The CEO of Ripple, Brad Garlinghouse Bats for the Crypto reserve of the US Calling BTC maximalism “the enemy of cryptographic progress.”

- BOJ to increase rates again in July, eventually an ocular increase to 1.5%, says the former control consumption (Reuters): the former member of the Bank of the Bank of Japan, Makoto Sakurai, predicts that the bank will increase the rates Of interest again in mid -2015, pointing at 1.5% within two years within two years. .

- The dollar rises when Trump rewards the tariff threats on the agenda (Bloomberg): the dollar strengthened against important currencies, and losses and yen exceed losses after falling more than 0.9%, since President Trump and the Treasury Secretary, Scott Besent, revived rates concerns.

- Altman, Openai’s best “models, since China’s Deepseek interrupts the global race (Financial Times): on Monday, the OpenAi CEO, Sam Altman, responded to the opponent of the generative Deepseek for Chatgit promising to accelerate the releases of products and deliver higher models.

In the ether