Bitcoin (BTC) remained stable during Friday’s Asian hours after Bank of Japan (BOJ) raised the cost of reference loans to the maximum in 17 years while increasing inflation forecasts.

“If the perspectives presented in the January Outlook report will be carried out, the bank will continue to increase the interest rate of the policy and adjust the degree of monetary accommodation,” said the policy statement, citing a positive perspective of wages and maintaining The orientation to continue increasing rates, according to Forexlive.

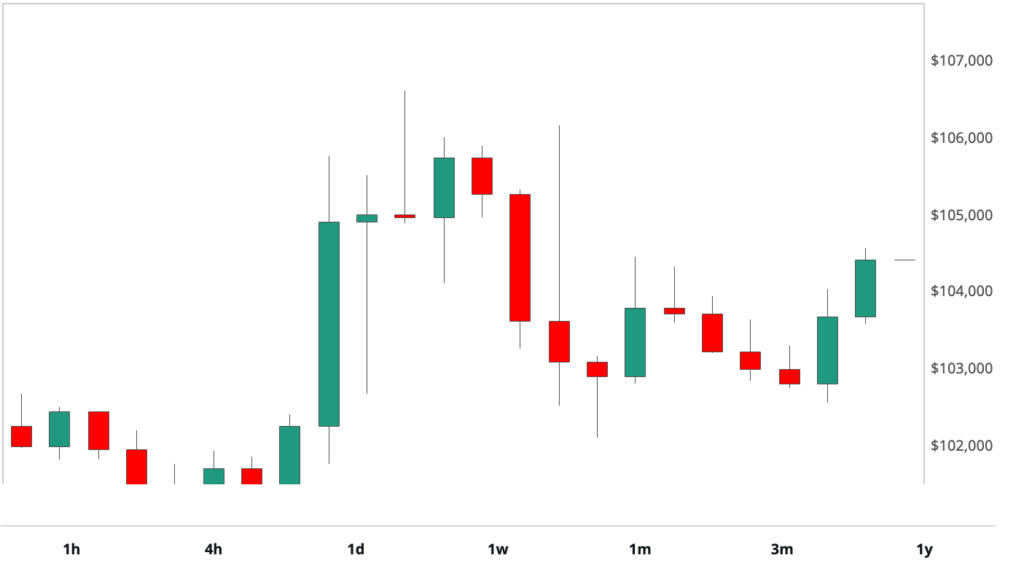

The Japanese anti-risgo increased more than 0.6% to 155.12 against the US dollar after the rate of rate. Even so, risk assets remained resistant. Bitcoin showed no signs of stress, merchant changing the day above $ 104,000. Futures linked to the S&P 500 were also negotiated with a floor.

This resilience in risk assets suggests that market attention is increasingly focused on possible policy developments under the presidency of Donald Trump. In comparison, the increase in rates of the Bank of Japan at the end of July had previously shaken risk active, including cryptocurrencies.

On Thursday, President Trump signed an executive order to prohibit the digital dollar and promote cryptographic and AI innovation in the US That leads the inflation of the refuge in the CPI, increased at a slower pace. last quarter. That has increased the hope that the Fed will return to its aggressive December rates forecasts.