Bitcoin

Bitcoin in Bitcoin cash attacked impressive profits in the last 24 hours, exceeding the weakness in BTC and the broader market.

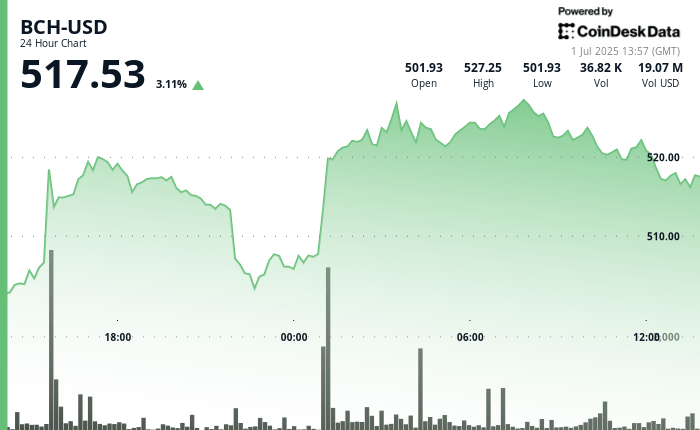

BCH has won more than 5% of $ 491.25 to $ 516 in 24 hours, with the negotiation volume tripling at a point as more than 120,000 Bch changed hands. Prices reached a maximum of $ 528 at one point, the level is seen for the last time on December 18, according to Coindesk data.

While it is said that a high volume rally is sustainable, the profits are not supported by the improvement in the fundamentals of the chain. According to AI of Coindesk, the foundations for the Bitcoin cash network recently reached six years in active daily addresses. According to data in the chain, the network is experiencing a “critical demand deficit”, which suggests that recent pricing action is more promoted by speculation than the use or adoption of the real network.

Key insights

- In the last 24 hours of June 30, from 13:00 to July 1, 12:00, BCH exhibited a significant upward trend, rising from $ 491.25 to $ 519.65, which represents a profit of 5.8%.

- The price range during this period was $ 37.80 (7.7%)With BCH reaching a peak of $ 527.37 at 03:00 on July 1 after an exceptional volume support.

- The key resistance was formed around $ 527 with multiple tests, while the support was established at $ 519- $ 520, which suggests a continuous bullish impulse despite the minor setback.

- More than 120,000 Bch changed hands at 01: 00: tripling the average volume of 24 hours, indicating a strong interest of the buyer.

- In the last 60 minutes from July 1 from 11:30 to 12:29, BCH experienced significant volatility, initially rising 0.55% of $ 519.67 to $ 522.55 at 11:57, before declineing 0.71% to close to $ 518.85.

BCH/BTC CROSS GOLDEN CROSS

The bitcoin bitcoin bitcoin that quotes binance (BCH/BTC) The torque, which tracks the relationship between BCH and BTC prices, has increased almost 20% in four weeks, reaching a maximum of six months of 0.0049, according to the view of the TrainingView data source.

BCH’s superior performance is charging impulse as evidenced by the 50 -day simple mobile average average crossing (SMA) Crossing over the 200 -day SMA.

The pattern indicates that the short -term impulse is now exceeding the broader trend, with the potential to evolve towards a significant upward market.