Gold (Xau) is reaffirming its status as a safe shelter asset amid the continuous fears of a commercial war led by the United States, while Bitcoin (BTC) struggles to gather traction. The dynamic is promoting the lowest bitcoin-cattle ratio.

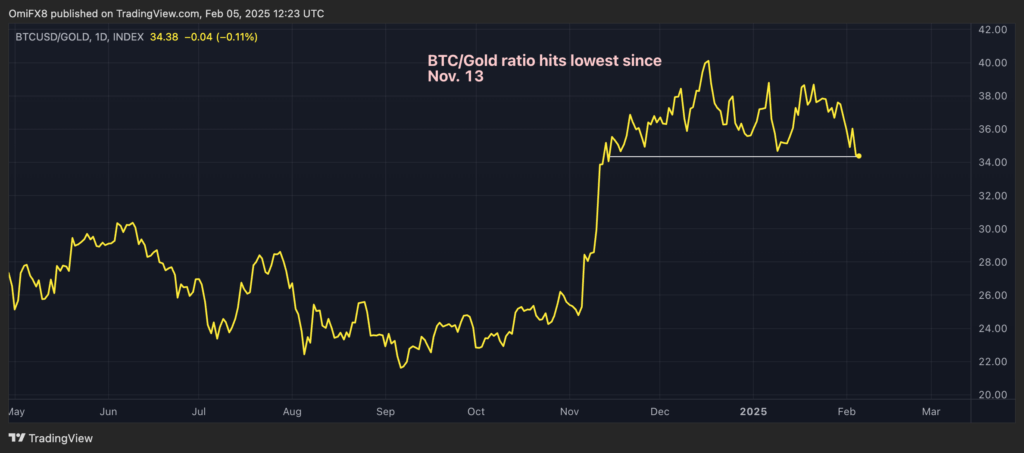

The relationship between the price of USD of Bitcoin and the price of the dollar per ounce of gold has been reduced to 34, the lowest since November 14, almost testing the maximum previous reach in March 2024, as shown by the data of the data of the TrainingView platform. It has dropped 15.4% since it reached a peak greater than 40 in mid -December.

The increase of almost the year of Gold of almost 10% at a record price per ounce of $ 2,877 has been promoted by safe demand in the midst of the growing commercial war between the United States and China, according to Reuters.

The threat of rates has future products of dedicated metal products that are operated substantially above the spot price in recent months. That has merchants carrying airplanes to the United States with yellow metal. The JPMorgan investment bank giant plans to deliver $ 4 billion gold bullion to New York this month, according to The Guardian. In addition, the Chinese gold demand has increased due to the holidays of the Spring Festival.

Meanwhile, entries in the Bitcoins Spot ETF (BTC) listed in the US.

“The purchase of the ETF could be compensated with simultaneous or future spots that sell (unwill $ 4 billion in tickets in tickets. The ETFs of the United States list since the release of inflation data three weeks ago.