Chipmaker Nvidia has put on such an incredible show by unveiling its Rubin AI computing platform at CES 2026 that it has sparked a huge shift among Bitcoin mining companies toward AI data center infrastructure services.

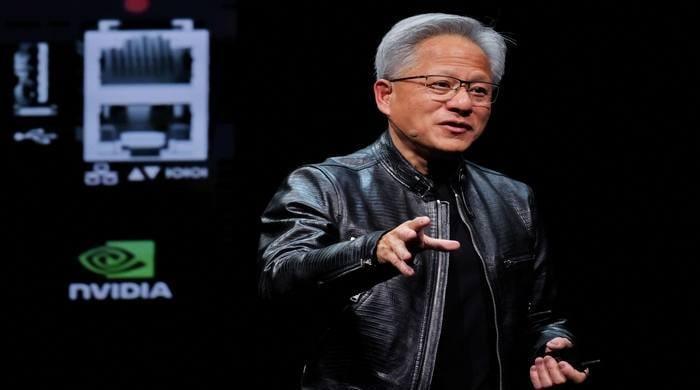

During Nvidia’s keynote at the tech show, CEO Jensen Huang revealed that Rubin AI is already in full production.

The transition of Bitcoin miners shows a critical survival strategy in the wake of the growing demand for AI computing power, which would completely disrupt the industry.

As NVIDIA executives explained, Rubin AI combines advanced GPUs and CPUs designed for demanding AI workloads to deliver approximately five times the performance of previous systems with improved efficiency.

The GPU giant plans to deploy Rubin systems through cloud partners later in 2026 to enable the creation of large-scale AI clusters.

While the case for miners to opt for AI seems logical, the operational challenges are troubling.

Traditional Bitcoin mining facilities, often basic warehouses with low redundancy, reportedly cannot meet the strict reliability standards required for AI training pools. These AI systems require Level 3 or Level 4 standards, ensuring 99.999% uptime, as even minor power interruptions can cause substantial financial losses.

The financial implications of this move are serious, with reports suggesting that equipping a 100-megawatt data center with advanced Rubin GPUs could require billions.

Many Bitcoin miners, often constrained by capital and dependent on volatile markets, face difficult decisions, including potential shareholder dilution, high-interest debt, or liquidating Bitcoin holdings at unfavorable times.

While mining heavyweights like Marathon Holdings and Bitdeer are testing adjustments to their strategies, smaller miners may struggle to survive, facing forced consolidation or exit from the market as resources continue to shrink due to growing demand for AI.