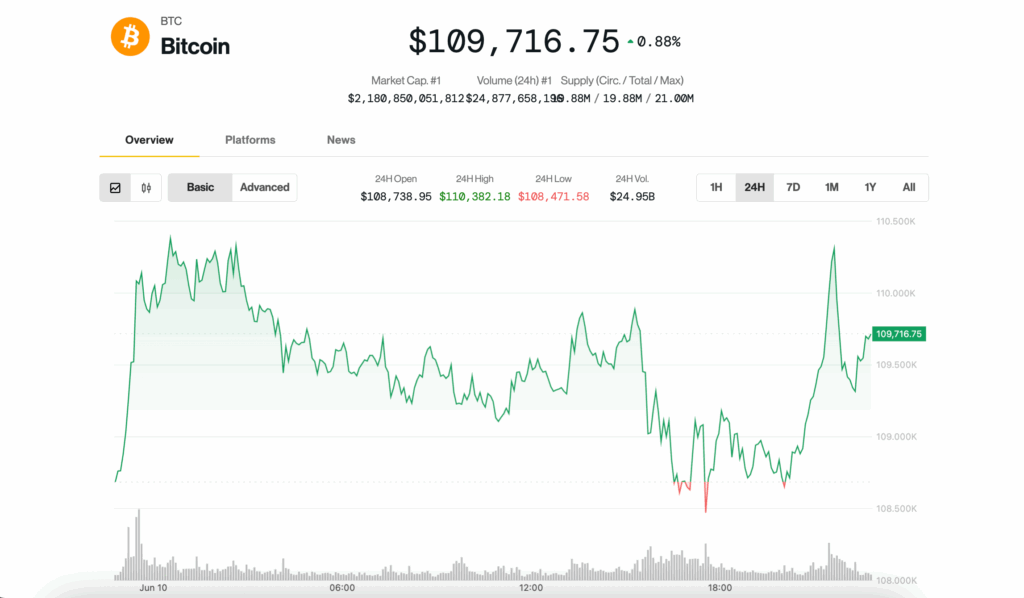

Bitcoin recaptured the level of $ 110,000 for the second consecutive day, perhaps dragged higher by even greater profits between Altcoins.

0.9% more than 1% in the last 24 hours, Bitcoin traded just above $ 110,000 shortly after the closure of the United States stock markets on Tuesday. The Coendesk 20, an index of the 20 main cryptocurrencies for market capitalization, excluding the stable, exchange currencies and memecoras, has increased 3.3% in the same period of time, mainly thanks to Ether

Solana, Chainlink, all winning 5%-7%.

However, the outstanding performances were presented by UNISWAP

and Aave, who fired a 24% and 13% lover, respectively. The measure was caused by optimistic comments on the issue of DEFI by the president of the Commission of Securities and Securities (SEC) Paul Atkins on Monday.

Things have remained relatively quiet in the front of the actions, with most cryptography stocks in the day. A remarkable exception is Semler Scientific (SMLR), a company that aims to follow the strategy play book (MSTR) and aspire the greatest amount of bitcoin as possible. The actions fell another 10% today, and the shares now quote the value of Bitcoin in their balance sheet.

Despite the profits of the day, the positioning in cryptography markets still reflects a large defensive tone.

“Financing rates and other leverage representatives point to a constantly cautious feeling in the market,” said Vetle Lunde, head of research of K33 Research, in a Tuesday report. “The broad risk appetite is remarkably weak, since BTC is quoted near the highest of all time.”

Binance BTC perpetual swaps registered negative financing rates in several days last week, with the average annualized financing rate that is now in only 1.3%, a level typically associated with local market funds instead of the maximums, Lunde said.

“Bitcoin does not usually reach its maximum point in environments with negative financing rates,” he wrote, added that the past instances of such positioning have more often preceded the demonstrations than corrections.

Bitcoin ETF flows leverage paint a similar image. The Bitcoin 2x ETF (Bitx) Proshares currently has an exposure equivalent to 52,435 BTC, well below its December 2023 of 76,755 BTC, and tickets remain silenced. This defensive positioning, according to Lunde, leaves room for a possible “healthy rally” in BTC.

Even so, not all market observers are convinced that the current price action marks the beginning of a sustainable breakup.

“Is this a real break that will continue? In my opinion, probably not,” said Kirill Kretov, an expert in senior automation of Coinpanel. “Most likely, it is part of the same volatility cycle in which we see a rally now, followed by a strong fall caused by a negative announcement or some other narrative change.”

According to Kretov, the current environment favors experienced merchants who can navigate the structure of the market -based market. Technically, it sees the next BTC key support levels at $ 105,000 and $ 100,000, areas that could be tested if the sale of the pressure returns.