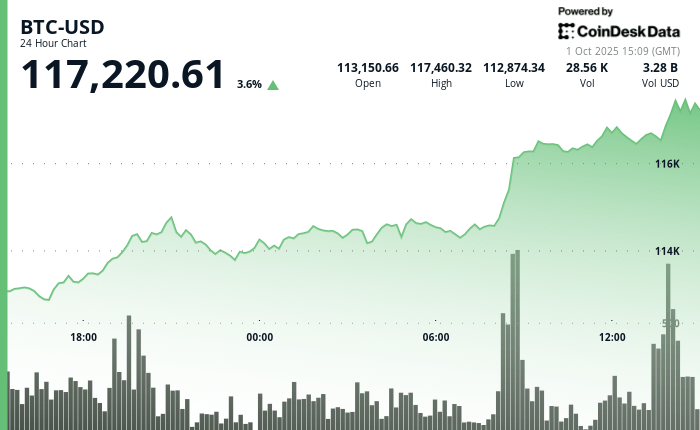

Cryptographic markets have had a positive start in what has been its strongest quarter of the year, with Bitcoin Increasing almost 4% in the last 24 hours to $ 117,400.

Already higher during the night, cryptographic prices increased even earlier in the US session.

Private payrolls saw their greatest decrease in 2.5 years in September, since private sector companies lost 32,000 jobs according to a new report of the ADP payroll processing firm. August was originally reported that 54,000 profits were reviewed with a loss of 3,000 jobs.

Merchants would generally be much more focused on the monthly job report of the Department of Labor due to Friday, but release will probably be delayed due to the closing of the current government.

Also on Wednesday, the ISM manufacturing PMI survey in September was online in 49.1, but the paid price index showed some inflation news, falling to 61.9 of 63.7 in August and prognostications for 63.2.

In actions, both the Nasdaq and S&P 500 fell slightly. Gold, which reached a new historical maximum of $ 3,921 before Wednesday, returned to $ 3,888.

A look at Altcoins Show’s profits in all areas, with Ether Solana sun and 5% -7% in the last 24 hours, exceeding Bitcoin’s progress.

In the midst of uncertainty about the next data launches to guide the monetary policy formulators about the economy, market participants, however, they universally expect the Federal Reserve to decrease the reference interest rates even more at the next October meeting. The CME Fedwatch tool shows a 99% probability of a 25 basic points, above 92% a week ago.

October begins strong

September has generally been a treacherous month for cryptography, but little less in the poor feeling of investors in recent times was that Bitcoin had one of its best September in many years, winning around 6% during the month.

In the last two days of September, the Bitcoin Spot ETFs gathered $ 950 million in tickets, more than reverting the $ 900 million outings the previous week.

“The next quarter is likely to see the start of the crypto market within reach,” said Noelle Acheson, author of The Crypto Is Macro Now Newsletter. Its perspective is driven by incoming macro queue winds in the form of flexibility of interest rates and another possible policy support, such as the control of the performance curve in the cards to keep the markets stable if the global economy becomes sour.

That environment should also be positive for the Altcoins, he said, with new ETF spot that they probably reach the market, calling the attention of investors to the sector. “The next room should bring the start of the ‘Alt season’, since the attention begins to get away from the ‘elders’ (BTC and ETH) and to smaller and more volatile tokens.”