Bitcoin

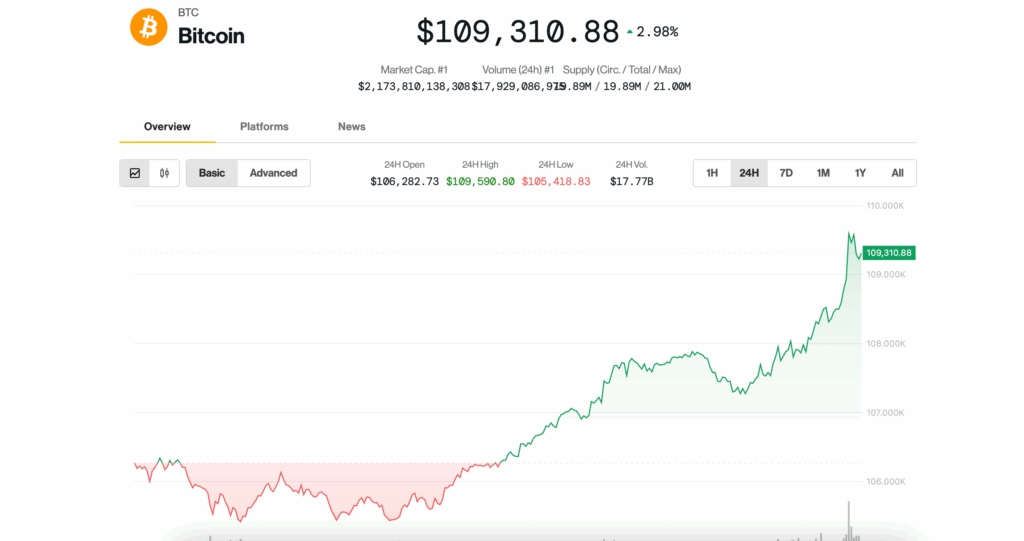

He is bouncing hard for $ 110,000 on Wednesday, shrinking from the brief risk wave on Tuesday that dragged the price below $ 106,000.

Recently, the largest cryptography negotiated at its strongest price since June 11, around $ 109,500, 3.5% more in the last 24 hours.

The action occurred when Donald Trump announced a commercial agreement with Vietnam, helping risk assets in all areas. The Nasdaq at noon is ahead of 0.8%.

According to the Agreement, the United States will impose a 20% rate on Vietnam’s goods and a 40% tax in transmitting goods: products enrupted through Vietnam on their way to USUS exports, in turn, they will not face tariffs when entering the Vietnamese market.

Increasing cryptographic feeling specifically could be the debut of Rex-Osprey Solana + ETF of bets (SSK)The first product of this type available in the US.

“Volume at $ SSK now at $ 20 million, which is really strong, the upper 1% for a new launch,” wrote Bloomberg Eric Balchunas recently. Balchunas said Solz, an ETF Sol based on futures that opened for business in March, made only $ 1 million volume on its first day of commerce.

Julio could be big (In any direction)

Julio is outlined as a potentially volatile month for Bitcoin, promoted by Trump administration policies, according to Vetle Lunde, K33’s head of research.

Trump is expected to firm a controversial draft expansive budget law called “Big Beautiful Bill” for Friday. The bill, which could expand the American deficit at $ 3.3 billion, is seen by some as optimistic for scarce assets such as BTC, Lunde said.

Another key date that advances is the deadline of rates on July 9, which could see a more aggressive commercial position of Trump.

Third, July 22 is the final deadline for action in the long -awaited cryptographic executive order, with possible updates on the strategic Bitcoin reserve of the USA.

“Julio is full of Trump’s latent volatility,” Lunde said. Even so, cryptographic markets are relatively quiet without excessive foam, he said.

“There are few reasons to expect a huge massive disappointment in the cryptography market, since cryptocurrency remains contained,” he said. “This favors maintaining exposure to the point and keeping the patient as we advance in a well known period for their seasonal apathy.”