Crypto’s rally was paused for a long time on Thursday when the merchants obtained some profits after weeks of implacable progress that Bitcoin raised BTC$103,013.35 Near record prices.

The consolidation occurred in the middle of a series of US economic data releases. UU. April retail sales lost expectations, producer prices increased less than expected, unemployment statements remained on their way, while the state manufacturing index of New York and the Fedyelfia Fed manufacturing survey showed commercial activities, signals that made little to shake the traditional markets. The S&P 500 added 0.4%, while Nasdaq ended up.

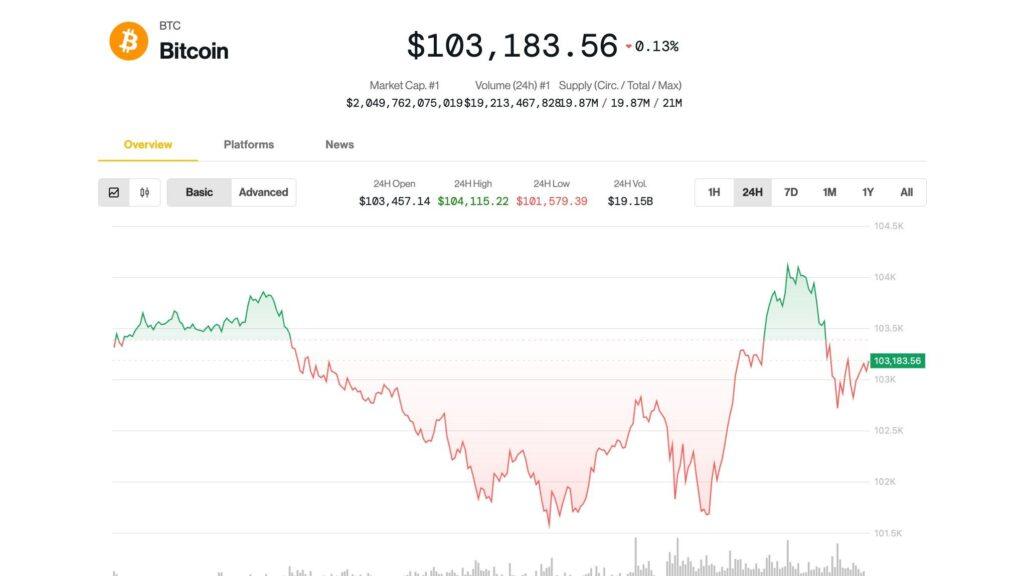

Bitcoin retired to $ 101,000 early in the US session. Before recovering above $ 103,000 later, modestly dropped in the last 24 hours.

Atcoins was worse with the Coindesk 20 wide market index that decreased 3% during the same period. Native tokens of suitable SUITABLE$5.32Avalanche Avax$23.33 and Unisswap UNI$6.20 6%-7%fell.

Cryptographic investors should not sweat today’s setback, they told Coindesk analysts.

“The current setback seems to be a correction within a broader bullish trend,” said Ruslan Lienkha, Youhodler Markets Chief.

The promoting impulse in the capital markets was moderated after the delay of the United China-states rate, and short-term merchants began to block themselves in the profits, he said. “This change in feeling has spread to more risky assets, including BTC.”

“Anything below 5% [price move] It can often be considered market noise, “said Kirill Kretov, an expert in commerce automation in Coinpanel.” It is likely that part of this movement comes from the taking of profits, since the merchants ensure profits after the recent rally. With so thin liquidity, even modest sales can quickly translate into notable corrections. “

By going back from short -term movements, the broader price action seems healthy without clear signs of an imminent top.

Vetle Lunde, a senior analyst of K33 Research, said that BTC has just left one of his longer periods of financing rates below neutral, a defensive positioning signal

“This resembles the October 2023 and 2024 risk reaction patterns and is far from looking like the prices action near the local market peaks,” Lunde wrote, who was optimistic that the lack of foam with BTC above $ 100,000 BTC tags the way for possible new new records.

According to Steno Research, cryptographic winds derive from a stealthy expansion in private credit, especially in the United States and Europe. In past bullfighting races, the cryptographic prospered in the expansion of base money: massive reserves of reserves by the central banks that fed the inflation of the assets in all areas. This time, however, the balances of the Central Bank of the FED and European have continued to be reduced through quantitative hardening.

“Many have indicated China’s liquidity injections as the main driver of the demonstration,” Samuel Shiffman wrote in a Thursday report. “But that loses the brand. The real support comes from the growth of the West Bank credit, a quieter and less visible engine behind this movement.”

He said that prospective indicators project global financial conditions that improve in the summer months, mainly driven by the weakening of the US dollar. Historically, this has led at higher BTC prices.

“We probably have space until June already before the image begins to change,” said Shiffman. “But once we approach the middle of July, the configuration becomes more complicated. Our main indicators suggest that the peak in financial flexibility may not last last August.”