The markets were put red on Friday in the renewed apprehension related to the rate.

Bitcoin

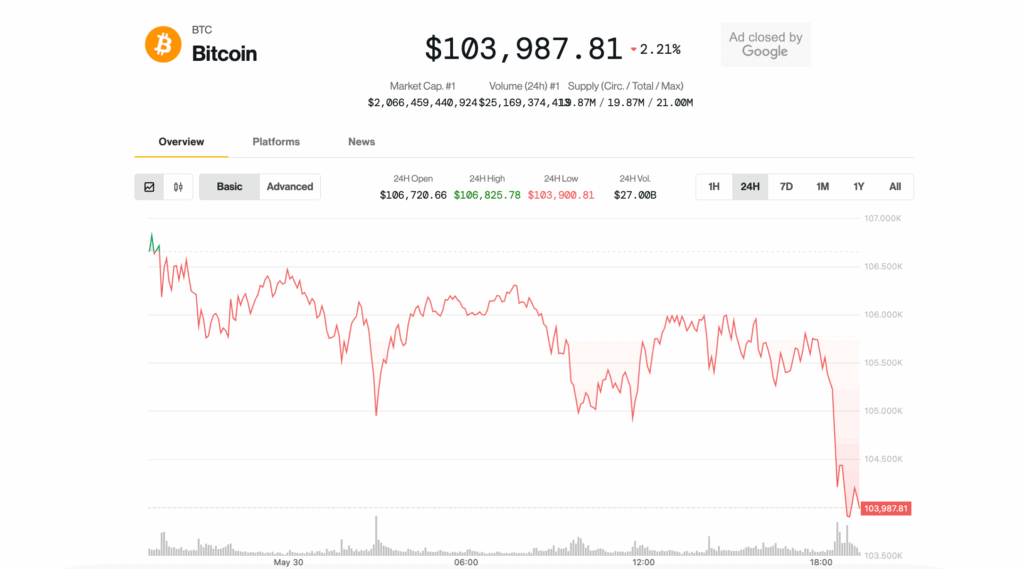

It has dropped 2.1% in the last 24 hours, quoting just above $ 104,000 after briefly reaching a minimum of $ 103,900 session. Coindesk 20, an index of the 20 main cryptocurrencies for market capitalization, with the exception of stables, memecoras and exchange currencies, further fell, in 4.2%.

The smart contract platforms were particularly affected, with Solana

Sui and Avalanche lost 6.3%, 7.8% and 7.3% respectively.

Crypto’s actions also received a success, especially the Bitcoin Bitdeer (BTDR) mining firm, 8.3% less in the day after a previous period that saw the 132% increase from April 16 to May 21. The strategy (Mstr) fell 2.7%, and coinbase (Coin) 1.3%.

The bleeding was not contained for crypto. The S&P 500 and Nasdaq have dropped 1% and 1.5% respectively, while gold lost 0.7%.

Rate shock between the United States and China: Round 2?

Behind the price action was the outbreak of the US commercial tensions. Once again after an agreement was reached earlier this month. The concerns occurred after President Donald Trump accused China in a position about the social truth of “raping” tariff truce among countries.

Meanwhile, the Treasury Secretary, Scott Besent, said in a Fox News interview that the conversations had “stagnated” with the Chinese representatives.

China, in response, urged the United States to “immediately correct their erroneous actions, to stop discriminatory restrictions,” BBC said.

The cooling between the USA and China helped risk assets in May, providing a tail wind so that BTC obtains a new record. Recallation now threatens to relax some of those profits.

Read more: Bitcoin whales seem to be calling the top when the price of BTC is consolidated