Bitcoin’s volatility bulls (BTC) can soon obtain their desire because seasonal patterns in the CBOE Volatility Index (VIX) suggest that Wall Street is ready for greater turbulence.

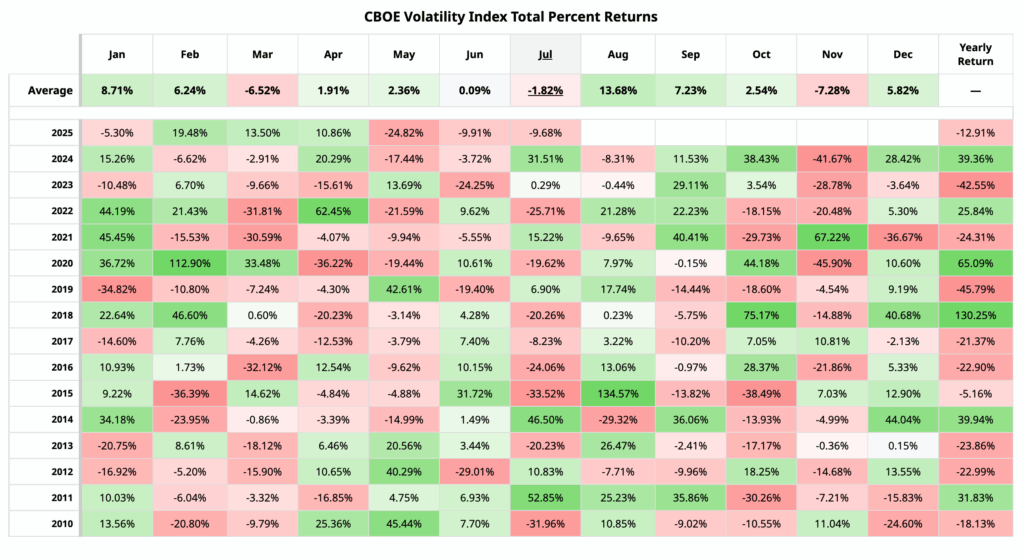

The VIX measures the early changes of 30 days of the reference point S&P 500. Its historical pattern, according to Barchart.com, shows a frequent increase in August, often preceded by a decrease in July.

August stands out for having the highest average monthly gain, 13.68%, in the last 15 years, increasing in 10 of those years, including a monumental increase of 135% in 2015.

Is the story repeated?

The VIX fell for the third consecutive month in July, extending the slide since the maximum of April. It reached a minimum of five months of 14.92 on Friday, according to Data Source TrainingView.

If the story is a guide, this decrease is likely to be preparing the scenario for the rise of August in volatility and risk aversion in Wall Street. The Vix, which has been nicknamed the fear meter, increases when shares prices decrease and fall when they increase.

In other words, the rise of the expected volatility on Wall Street could be marked by a fainting of the stock market, which could be spilled in the Bitcoin market.

Bitcoin tends to track the feeling on Wall Street, especially in technological actions, quite closely. BTC implicit volatility indices have developed a strong positive correlation with VIX, indicating a constant evolution in VIX fear meters. Since November, the implicit volatility indices of 30 days of BTC have decreased sharply, finishing the positive correlation with the spot price.

Read: Bitcoin’s low volatility rally from $ 70k to $ 118k: a transition story of the dynamics similar to Wild West A Wall Street