The feeling of the Bitcoin market (BTC) has become bassist, with future Nasdaq with Wall Street technology that negotiate 700 lower points. Risk aversion is promoted by concerns that the Startup of Renteable Chinese artificial intelligence could significantly challenge the technological domain of the United States.

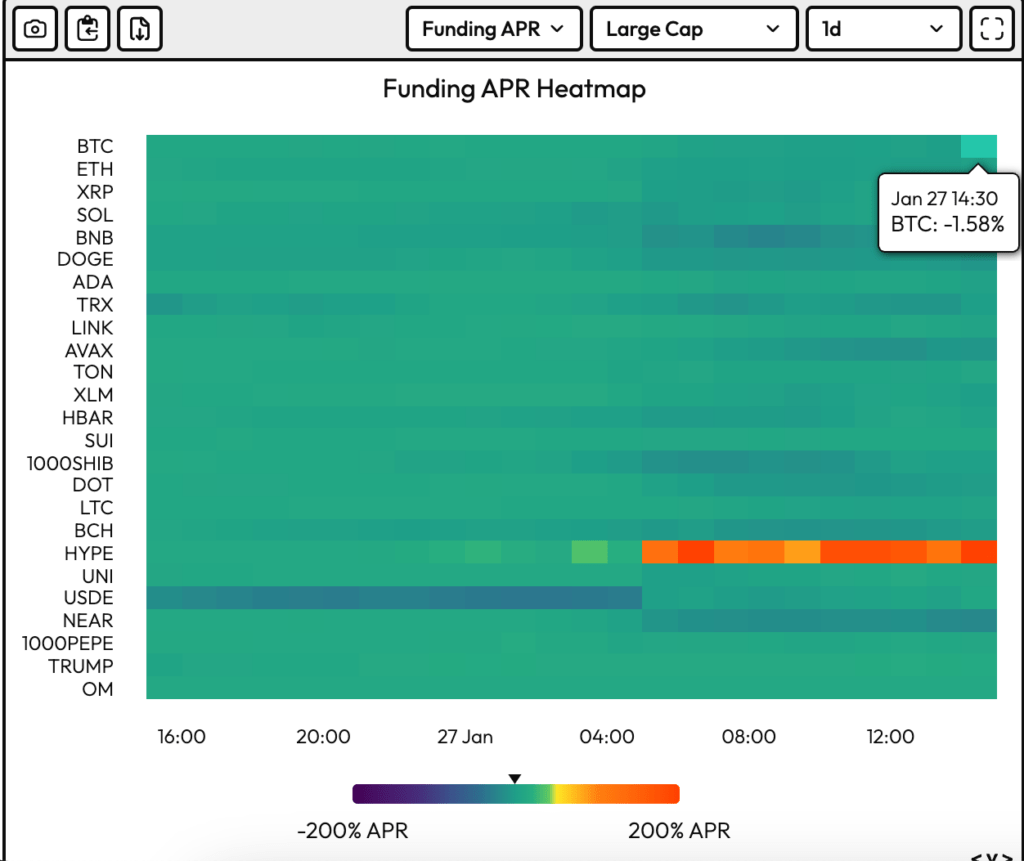

Bitcoin’s perpetual futures financing rates, periodic payments made between long and short positions in perpetual futures contracts, have turned negative, according to veil data from the data source. It is a sign of a more bearish feeling in the market: merchants are chasing short positions in the anticipation of lower prices.

The main cryptocurrency per market value has decreased more than 3% from the first hours of Asian, reaching minimums below $ 98,000 at one point, according to Coindesk data. Futures linked to Nasdaq have fallen more than 3.5%, with Nvidia, the Bell-Wether for all the things of AI, 10% less in the trade prior to the market.

“Today’s mass sale occurs after President Donald Trump last week gave green light to a working policy that stopped remarkably in confirmation that the United States would establish a Bitcoin reserve. Meanwhile, meanwhile, The China Depseek artificial intelligence startup seems to have scared technological actions, such as its success, suggests that it is possible to build AI models that cost less than IA headlines in the United States, “he said in an email by Pet Kozyakov, co -founder, co -founder and CEO of Mercuroo.

Historically, however, the negative flip in financing rates has tended to mark local price funds. In addition, there is always the risk of a little squeeze: the bears throw in the towel and face their bets, pressing prices. That said, the financing rate has turned by little, which means that it is too early to call BTC short as a superpoblated trade.