Bitcoin (BTC) has been quoting in an unbearably strict range just below $ 120,000, but the rally is losing the impulse quickly as the market enters what has historically been a soft month for cryptography, warned a 10x Research report.

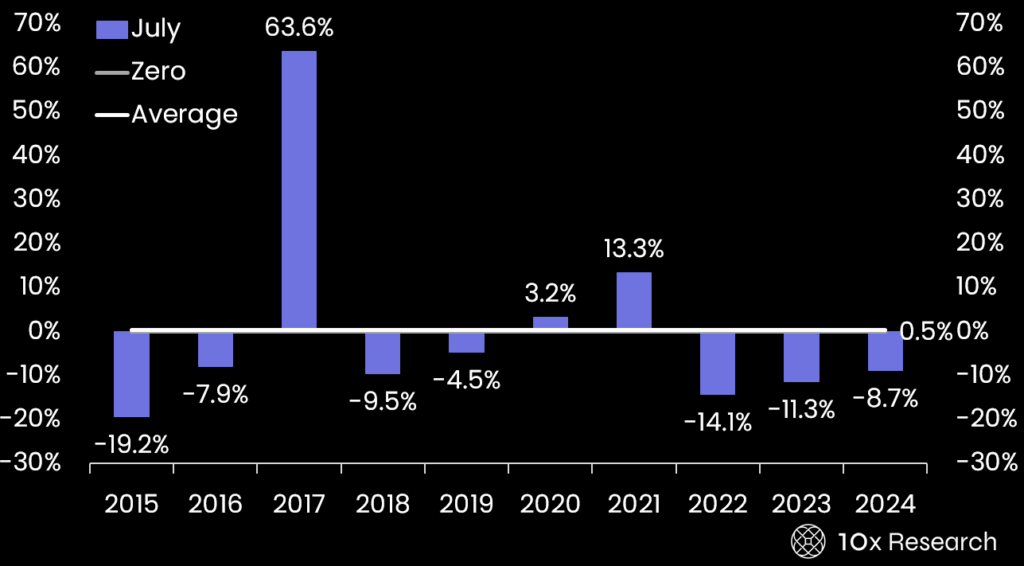

August has been the weakest month of Bitcoin during the last decade, with only three positive years and others delivering losses from 5 to 20%, the report said.

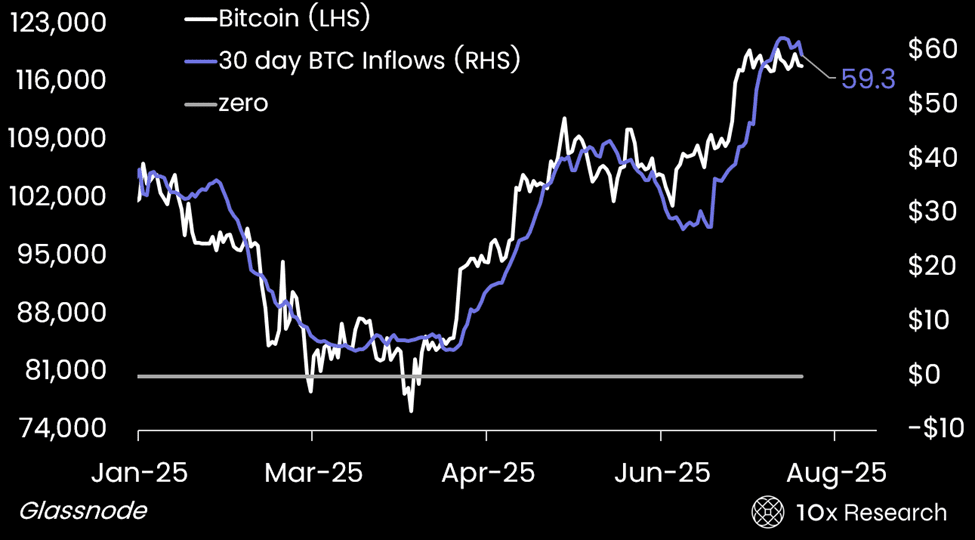

The report also marked a slowdown in capital flows on the Bitcoin Network, a key price action controller this year. Total cumulative tickets on the network now exceed $ 1 billion, with $ 206 billion arriving in 2025.

But the 30 -day roller average fell from $ 62.4 billion to $ 59.3 billion, that could mark the start of a consolidation phase, according to the report, reflecting past peaks in this metric, such as Q1 and the fourth quarter of 2024.

“Time is running out and, despite billions of capital entries of corporate treasure bonds, the real impact of the price has been surprisingly silenced,” Markus Thielen wrote, co -founder and main analyst in 10x. “This raises the possibility that even with continuous support, the market may not meet the type of rise that many expect.”

The report predicts a probable break below $ 117,000, with a $ 112,000 support and a deeper floor around the threshold of $ 106,000– $ 110,000.

Even so, BTC Bulls can hold on to the hope that the Atypical Profit of August occurred in 2013, 2017 and 2021, during the years after the Bitcoin audience that coincides with the bullish markets.

And 2025 could be a year like that.

Read more: BTC faces Golden Fibonacci Hurdle at $ 122K, XRP has support for $ 3