The Bitcoin bull (BTC), once he looks with confidence towards the future, is reconsidering his long -term bullish condemnation.

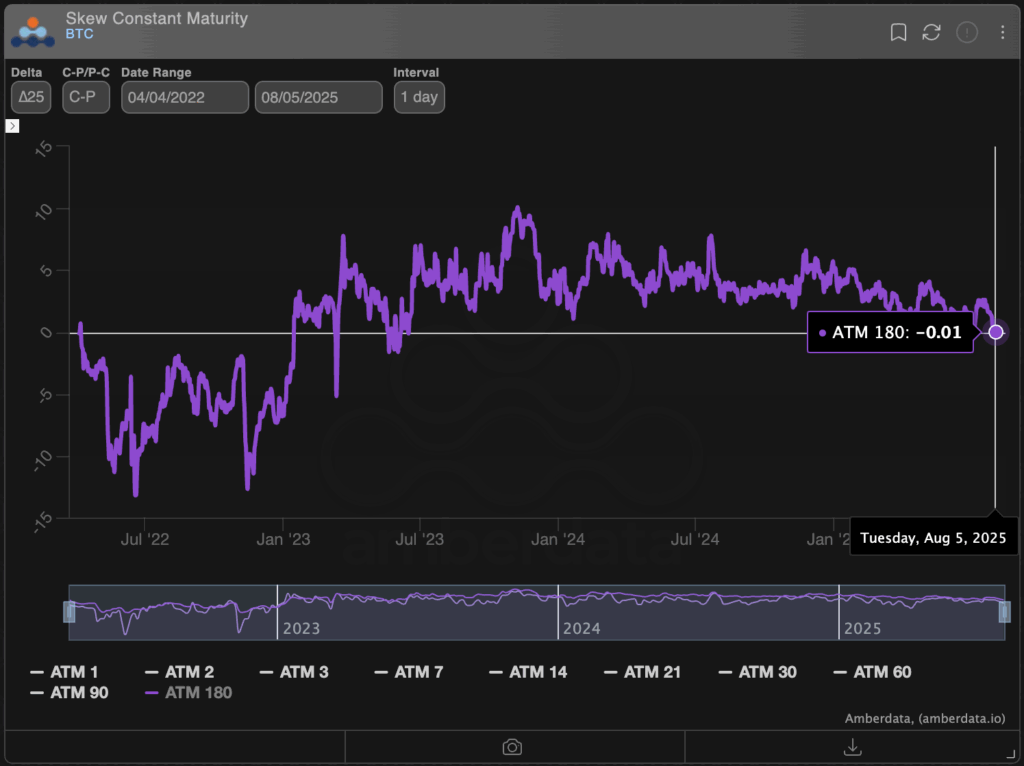

That is evident from the 180 -day bias, measuring the difference in implicit volatility (prices) between the options for the call and sale of money out of money. The metric has recently retired to zero, according to the Amber Data Source, indicating that the feeling of the long -term market has changed from bullish to neutral. The change occurs when some analysts warn about a bearish market in 2026.

A similar restart occurred at the beginning of the previous market of Bitcoin Bear, according to Griffin Ardern, head of commerce and research of options at Crypto Financial Platform Blofin.

“I have noticed a fairly worrying sign with the recent market setback. Bitcoin’s upward feeling due to the options of less month has disappeared, and now it is firmly neutral,” Ardern told Coindesk. “This means that the options market believes that it is difficult for BTC to establish a long -term upward trend, and the probability of new maximums in the coming months is decreasing.”

“A similar situation occurred for the last time in January and February 2022,” he added.

A sales option offers insurance against price falls in the underlying asset, while a call provides asymmetric bullish exposure. A positive bias implies a bias towards the calls, which indicates optimism in the market, while a negative bias suggests otherwise.

The neutral change in 180 -day bias could be driven in part by structured products that sell greater strike purchase options to generate additional performance in the upper part of spot market holdings.

The popularity of the so -called covered call strategy could be promoting implicit volatility in the call in relation to the puts.

Macro reservoir

BTC fell more than 4% last week, almost testing its previous record of $ 11,965, since the central PCE, the Fed’s favorite inflation measure, increased in June, while disappointed non -agricultural payrolls, stealing concerns about the economy.

The price drop has pushed short -term biases below zero, a sign of merchants seeking downward protection through the puts.

According to Ardern, the inflationary effects of the “impulses of the supply chain” are already appearing in the economic data.

“Although the drop in car prices in the last IPC report compensate for prices to the increase in other goods, one thing is undeniable: the impulse of the west coast of the Pacific has reached the east coast, and retailers are already trying to transmit rates and a host of the associated costs for consumers. While sellers and commercial companies and commercial companies are working Supply, price increases will still occur, which increases the most moderate prices.

According to JPMorgan, it is likely that the tariffs of President Donald Trump raise inflation in the second half of the year.

“The inflation of the global nucleus is expected to increase 3.4% (annualized rate) in the second half of 2025, largely due to an American peak related to the rate,” said the investment bank analysts, and add that cost pressures will probably be concentrated in the United States

An increase in inflation could make Fed reduce rates. Trump has repeatedly criticized the Central Bank for maintaining high rates at 4.25%.

Merchants will receive the Non -Manufacturing ISM PMI later on Tuesday, providing information on inflation in the service sector, which represents a significant part of the United States economy. The releases of Julio CPI and PPI will follow him at the end of this week.

Read more: Bitcoin still on the way for $ 140k this year, but 2026 will be painful: Elliott Wave Expert